The Kimpton Corporation pays the following taxes during 2021: Also, the county treasurer notifies Kimpton that it

Question:

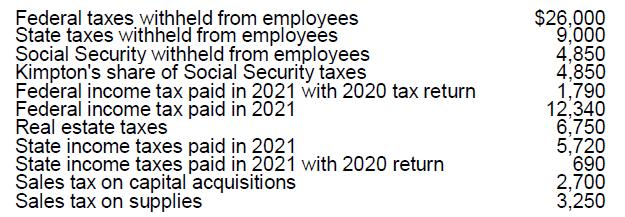

The Kimpton Corporation pays the following taxes during 2021:

Also, the county treasurer notifies Kimpton that it is being assessed a special real estate tax of $64,000 for upgrading the sidewalks and sewer connections in the area. The special tax is payable in 4 yearly installments of $16,000. What amount can Kimpton deduct for taxes paid in 2021?

Transcribed Image Text:

Federal taxes withheld from employees State taxes withheld from employees Social Security withheld from employees Kimpton's share of Social Security taxes Federal income tax paid in 2021 with 2020 tax return Federal income tax paid in 2021 Real estate taxes State income taxes paid in 2021 State income taxes paid in 2021 with 2020 return Sales tax on capital acquisitions Sales tax on supplies $26,000 9,000 4,850 4,850 1,790 12,340 6,750 5,720 690 2,700 3,250

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (6 reviews)

The Kimpton Corporation can only deduct the taxes that it actually paid in 2021 As an employer Kimp...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

Concepts In Federal Taxation 2022

ISBN: 9780357515785

29th Edition

Authors: Kevin E. Murphy, Mark Higgins, Tonya K. Flesher

Question Posted:

Students also viewed these Business questions

-

The Kimpton Corporation pays the following taxes during 2016: Federal taxes withheld from employees ................................ $26,000 State taxes withheld from employees...

-

The Kimpton Corporation pays the following taxes during 2011: Federal taxes withheld from employees ........ $26,000 State taxes withheld from employees .......... 9,000 Social Security withheld from...

-

The Kimpton Corporation pays the following taxes during 2020: Federal taxes withheld from employees .......................$ 26,000 State taxes withheld from employees...

-

Consider the following velocity distribution curves A and B. a. If the plots represent the velocity distribution of 1.0 L of He(g) at STP versus 1.0 L of Cl2(g) at STP, which plot corresponds to each...

-

How has computer-integrated-manufacturing (CIM) technology affected overhead application?

-

Anthony lends money to Frank, who dies without having repaid the loan. Franks widow, Carol, promises Anthony to repay the loan. Upon Carols refusal to pay the loan, Anthony brings suit against Carol...

-

E 8-10 Computations for sale of an interest Pam Corporation acquired a 90 percent interest in Sun Corporation on July 1, 2017, for $675,000. The stockholders equity of Sun at December 31, 2016, was...

-

List the following classifications of accounts in all of the columns in which they appear on the work sheet, with the exception of the Adjustments columns. (Example: Assets) Assets ...................

-

On January 1, 2021, Tennessee Harvester Corporation issued debenture bonds that pay interest semiannually on June 30 and December 31. Portions of the bond amortization schedule appear below: Payment...

-

Simplex Corporation provides the following information at the end of 2015. Salaries payable to workers at the end of the year ................ $ 3,500 Advertising expense for the year...

-

Evelyn is single and a self-employed engineer. During 2021, Evelyn's income from her engineering business is $55,000. Evelyn pays $3,100 for her medical insurance policy. a. How should the medical...

-

KOM pays the following insurance premiums during 2021: a. If KOM uses the accrual method of accounting, what is the insurance expense deduction for 2021? b. If KOM uses the cash method of accounting,...

-

Explain why a customer might be willing to work more cooperatively with a small number of suppliers rather than pitting suppliers in a competition against each other. Give an example that illustrates...

-

Year 5% 6% 4 3.546 3.465 5 7% 3.387 3.312 4.329 4.212 4.100 8% 3.993 5.076 4.917 4.767 4.623 Present Value of an Annuity of $1 at Compound Interest 9% 10% 11% 12% 13% 14% 15% 3.240 3.170 3.102 3.037...

-

2. Determine the overturning stability of the cantilever retaining wall shown. The equivalent fluid density is 5.5 kN/m, soil density is 18 kN/m, and the concrete weighs 23.5 kN/m. (5 pts) 2 m 2 m 2...

-

A. For a certain two-dimensional, incompressible flow field the velocity component in the y direction is given by v = 3xy + xy 1. (05 pts) Short answer, what is the condition for this flow field to...

-

Cho0se a hazardous material to cr3ate a pr3sentation on (i.e. sulfuric acid, explosives, used needles, there are many types of hazardous materials) Cr3ate a presentation (P0werPoint, Open0ffice...

-

If det [a b] = c d 2 -2 0 a. det c+1 -1 2a d-2 2 2b -2 calculate:

-

Cypress Books expects to earn $55,000 next year after taxes. Sales will be $400,008. The store is located near the shopping district surrounding Sheffield University. Its average product sells for...

-

In the series connection below, what are the respective power consumptions of R, R2, and R3? R R www 4 V=6V P1-3 W; P2=3W; and P3= 3 W OP10.5 W; P2-1 W; and P3= 1.5 W P1=1.5 W; P2=1 W; and P3= 0.5 W...

-

Which of the following are passive activities? a. Marvin is a limited partner in the Jayhawk Beach Club and owns a 20% interest in the partnership. b. Marcie owns a royalty interest in an oil and gas...

-

Sidney and Gertrude own 40% of Bearcave Bookstore, an S corporation. The remaining 60% is owned by their son Boris. Sidney and Gertrude do not participate in operating or managing the store, and they...

-

Aretha and Betina own a 10-unit apartment complex. Aretha owns a 60% interest in the apartment complex, and Betina has a 40% interest. Aretha is an investment banker and spends 120 hours helping to...

-

Problem 12.6A (Algo) Liquidation of a partnership LO P5 Kendra, Cogley, and Mel share income and loss in a 3.21 ratio (in ratio form: Kendra, 3/6: Cogley, 2/6; and Mel, 1/6), The partners have...

-

Melody Property Limited owns a right to use land together with a building from 2000 to 2046, and the carrying amount of the property was $5 million with a revaluation surplus of $2 million at the end...

-

Famas Llamas has a weighted average cost of capital of 9.1 percent. The companys cost of equity is 12.6 percent, and its cost of debt is 7.2 percent. The tax rate is 25 percent. What is the companys...

Study smarter with the SolutionInn App