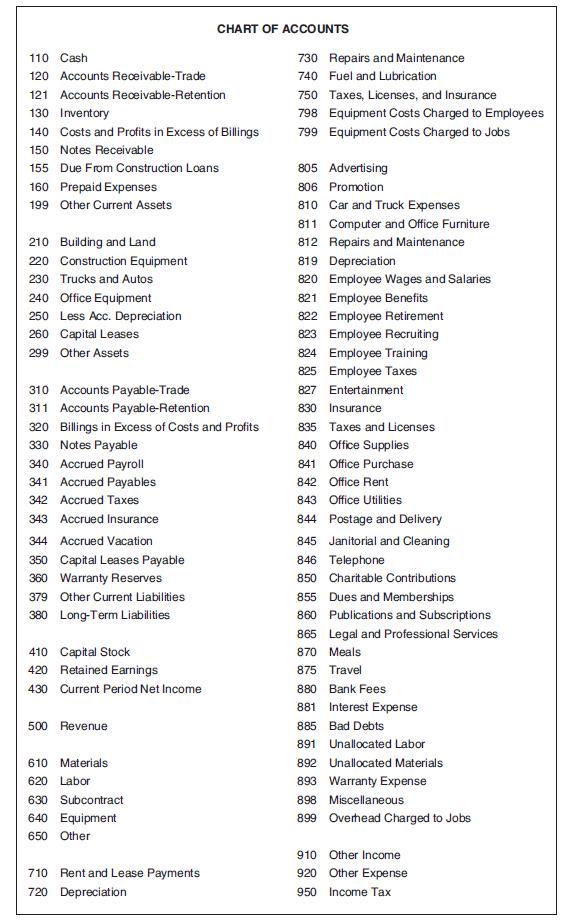

Obtain a chart of accounts from a local construction company. Compare and contrast the companys chart of accounts with the chart of accounts in Figure

Obtain a chart of accounts from a local construction company. Compare and contrast the company’s chart of accounts with the chart of accounts in Figure 2-1. Does the company’s chart of accounts have any accounts that are not shown in Figure 2-1? If so, what are they and what are they used for? What is the company’s core market (e.g., commercial, residential, specialty contractor)?

How does the company’s core market affect their chart of accounts? Come to class prepared to discuss your findings.

In Figure 2.1

110 Cash 120 Accounts Receivable-Trade 121 Accounts Receivable-Retention 130 Inventory 140 Costs and Profits in Excess of Billings 150 Notes Receivable 155 Due From Construction Loans 160 Prepaid Expenses 199 Other Current Assets 210 Building and Land 220 Construction Equipment 230 Trucks and Autos 240 Office Equipment 250 Less Acc. Depreciation 260 Capital Leases 299 Other Assets 310 Accounts Payable-Trade 311 Accounts Payable-Retention 320 Billings in Excess of Costs and Profits 330 Notes Payable 340 Accrued Payroll 341 Accrued Payables 342 Accrued Taxes 343 Accrued Insurance 344 Accrued Vacation 350 Capital Leases Payable 360 Warranty Reserves 379 Other Current Liabilities 380 Long-Term Liabilities 410 Capital Stock 420 Retained Earnings 430 Current Period Net Income CHART OF ACCOUNTS 730 Repairs and Maintenance 740 Fuel and Lubrication 750 Taxes, Licenses, and Insurance 798 Equipment Costs Charged to Employees 799 Equipment Costs Charged to Jobs 500 Revenue 610 Materials 620 Labor 630 Subcontract 640 Equipment 650 Other 710 Rent and Lease Payments 720 Depreciation 805 Advertising 806 Promotion 810 Car and Truck Expenses 811 Computer and Office Furniture Repairs and Maintenance 812 819 Depreciation 820 Employee Wages and Salaries 821 Employee Benefits 822 Employee Retirement 823 Employee Recruiting 824 825 827 830 Insurance 835 Taxes and Licenses 840 Office Supplies Employee Training Employee Taxes Entertainment 841 Office Purchase 842 Office Rent 843 Office Utilities 844 Postage and Delivery 845 Janitorial and Cleaning 846 Telephone 850 Charitable Contributions 855 Dues and Memberships 860 Publications and Subscriptions 865 Legal and Professional Services 870 Meals 875 Travel 880 Bank Fees 881 Interest Expense 885 Bad Debts 891 Unallocated Labor 892 Unallocated Materials 893 Warranty Expense 898 Miscellaneous 899 Overhead Charged to Jobs 910 Other Income 920 Other Expense 950 Income Tax

Step by Step Solution

3.32 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

A chart of accounts is a listing of all the accounts used in the general ledger of a company It prov... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards