Donald Sheelen was born into a middleclass family in upstate New York in 1946. In high school,

Question:

Donald Sheelen was born into a middle‑class family in upstate New York in 1946.

In high school, the handsome Sheelen was the prototype of the all‑A merican boy, excelling in both academics and athletics. Following graduation, Sheelen attended the University of Dayton, where he was elected president of his senior class and named a Big Man on Campus. After earning an MBA from Syracuse University, Sheelen landed a job with a large Wall Street brokerage firm and then three years later accepted a middle-management position with Johnson & Johnson. In 1980, at the age of 34, Sheelen was hired by Regina Company, Inc., and placed in charge of the company’s marketing department.

Regina was a wholly-owned subsidiary of the large conglomerate General Signal Corporation. Founded in Rahway, New Jersey, in 1892, Regina had originally been a music box manufacturer before entering the floor care industry in the early 1900s.

Throughout most of its existence, Regina was known as a complacent, slow-growth company and was dominated within the floor care industry by Hoover and Eureka.

Donald Sheelen quickly changed Regina’s complacent image and tackled the sizable task of moving the company out of the shadows of its two larger competitors.

Cornflakes, Celebrity and Cash for Donald Sheelen When Sheelen joined Regina, the company had annual sales approaching \($60\) million.

The ambitious Sheelen was not satisfied with Regina’s small share of the vacuum cleaner market or the fact that the company depended heavily on one product. He believed that for Regina to challenge Hoover and Eureka, the company had to expand its product line and dramatically increase its annual advertising expenditures. By 1984, Sheelen, who had been promoted to company president the previous year, had introduced a series of new Regina products, including a portable spa and an upright vacuum cleaner. To promote these and other new products, he poured millions of dollars into Regina’s advertising budget. Eventually, the company’s annual advertising expenditures exceeded 20 percent of its annual sales and eclipsed the combined advertising outlays of Hoover and Eureka.

Shortly after being appointed Regina’s president, Sheelen announced that he intended to make Regina the industry’s dominant firm by the end of the decade.

He repeatedly vowed that Regina would “bomb” Hoover, the number one firm in the industry at the time. The exuberant executive even laid a Hoover doormat outside his office so that each day he could “walk over” his company’s major rival.1 Sheelen became well known both inside and outside the floor care industry for his so‑called cornflake routine that he often performed at trade shows and during news conferences. This routine involved sprinkling crushed cereal on a carpet and then demonstrating that a Regina vacuum cleaner did a much better job of cleaning up the mess than a comparable Hoover product. Sheelen converted this demonstration into a television advertisement and was promptly sued by Hoover. He was forced

to withdraw the ad from the airwaves after Hoover proved that the Regina vacuum cleaner used in the commercial had an industrial‑strength suction that was not available on the model sold to retail customers.........

Questions:-

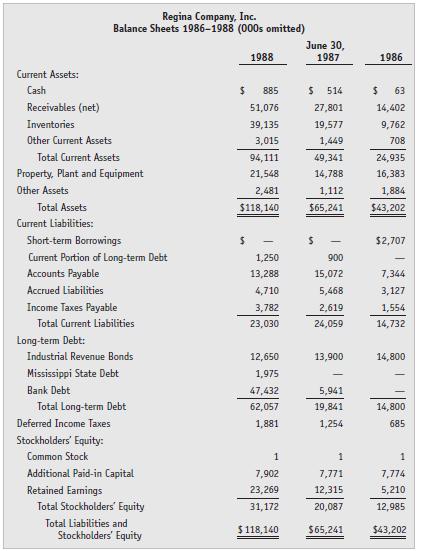

1. Prepare common-sized financial statements for Regina for the period 1986 to 1988. Also, compute key liquidity, solvency, activity, and profitability ratios for the years 1987 and 1988. Given these data, identify what you believe were the high‑risk financial statement line items for the 1988 Regina audit.

2. Identify audit procedures that might have resulted in Peat Marwick discovering

(a) the \($5\) million of bogus sales recorded by Regina executives during fiscal 1988 and

(b) the intentional understatement of the company’s sales returns for that same period.

3. Identify and discuss the principal audit objectives associated with the performance of year‑end sales cutoff tests. Which of the fraudulent errors in Regina’s accounting records would such tests have likely uncovered? Explain.

4. Were the Peat Marwick auditors justified in relying on Golden’s assertion that the ship‑in‑place sales transaction they discovered was an isolated item? If not, what additional audit procedures do you believe Peat Marwick should have performed at that point?

5. As noted in this case, one Peat Marwick partner stated that his firm preferred to trust the people it was auditing. Should auditors trust their clients? If so, under what circumstances and to what extent?

Step by Step Answer: