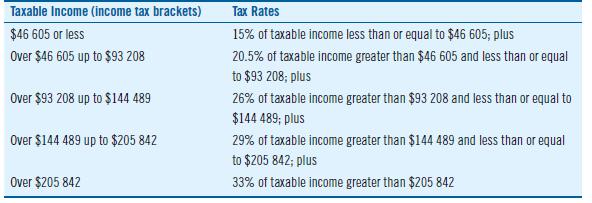

Use the 2018 federal income tax brackets and rates in Table 3.3 to answer the following question.

Question:

Use the 2018 federal income tax brackets and rates in Table 3.3 to answer the following question.

Sonja reported a taxable income of $96 300 on her 2018 income tax return. How much federal income tax should she report?

Table 3.3

Transcribed Image Text:

Taxable Income (income tax brackets) Tax Rates $46 605 or less 15% of taxable income less than or equal to $46 605; plus Over $46 605 up to $93 208 20.5% of taxable income greater than $46 605 and less than or equal to $93 208; plus Over $93 208 up to $144 489 26% of taxable income greater than $93 208 and less than or equal to $144 489; plus Over $144 489 up to $Z05 842 29% of taxable income greater than $144 489 and less than or equal to $205 842; plus Over $205 842 33% of taxable income greater than $205 842

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 58% (12 reviews)

To calculate the federal income tax for Sonja we need to determine the tax bracket th...View the full answer

Answered By

Nikka Ella Clavecillas Udaundo

I have a degree in psychology from Moi University, and I have experience working as a tutor for students in both psychology and other subjects. I am passionate about helping students learn and reach their potential, and I firmly believe that everyone has the ability to succeed if they receive the right support and guidance. I am patient and adaptable, and I will work with each individual student to tailor my teaching methods to their needs and learning style. I am confident in my ability to help students improve their grades and reach their academic goals, and I am excited to work with a new group of students.

0.00

0 Reviews

10+ Question Solved

Related Book For

Contemporary Business Mathematics With Canadian Applications

ISBN: 9780135285015

12th Edition

Authors: Ali R. Hassanlou, S. A. Hummelbrunner, Kelly Halliday

Question Posted:

Students also viewed these Mathematics questions

-

Sonja reported a taxable income of $86 300 on her 2012 income tax return. How much federal income tax should she report? Use the 2012 federal income tax brackets and rates in Table 3.3 to answer the...

-

Sonja reported a taxable income of $96300 on her 2015 income tax return. How much federal income tax should she report?

-

Use information from Table 16.2 to answer the following questions about sound in air. At 20oC the bulk modulus for air is 1.42 X 105 Pa and its density is 1.20 kg/m3. At this temperature, what are...

-

Complete the horizontal analysis of the following comparative income statement? Mile Wide Organic Woolens, Inc. Comparative Income Statement For Years Ending December 31, 2012 and 2013 Increase...

-

Why is Mount Everest getting taller? Why is Pacific Ocean shrinking?

-

Killing weeds A biologist would like to determine which of two brands of weed killer, X or Y, is less likely to harm the plants in a garden at the university. Before spraying near the plants, the...

-

2. Identify and discuss real examples of companies with a competitive advantage based on customer lock-in as opposed to product innovation. Which type of competitive advantage do you expect to...

-

Transactions related to revenue and cash receipts completed by Sterling Engineering Services during the period June 2-30, 2016, are as follows: June 2. Issued Invoice No. 717 to Yee Co., $1,430. 3....

-

ACC-650 TOPIC 4 Assignment Question 6 of 11 - /5 View Policies Current Attempt in Progress Marigold Incasements manufactures protective cases for MP3 players. During November, the company's workers...

-

Current Attempt in Progress Grouper Incorporated factored $134,400 of accounts receivable with Engram Factors Inc. on a with recourse basis. Engram assesses a 2% finance charge of the amount of...

-

Solve the following problem. Using 2012 as the base period, compute a series of simple price indexes for the price of gold for the period 2012 to 2017. Interpret your results. 2012 2013 2014 2015...

-

Solve of the following problem. A clerk whose salary was $740 per week was given a raise of $92.50 per week. What percent increase did the clerk receive?

-

Should a mission statement be customer focused?

-

If a change were made to Technical Spec 2 in the product's design, this would likely change the customer's opinion of which value feature the most? Quick Start Quick Start QFD Matrix 1 = Strong...

-

You are a quality management consultant for the Beserk Tennis Ball Company. Beserk is redesigning its current model of tennis ball, and you are asked to use QFD analysis to make suggestions about...

-

You are reviewing a tender evaluation that is to be awarded on lowest total price. The bid evaluations follow: To which company should the contract be awarded? Company Capital Cost Maintenance...

-

You have invited four companies to bid on a consulting project. All four companies answered your invitation to tender, but the bids vary in the number of hours each company estimates will be required...

-

Boston Cycles inventory data for the year ended December 31, 2011, follow: Assume that the ending inventory was accidentally overstated by $2,200. Requirement 1. What are the correct amounts for cost...

-

What does the Gibbs function of formation g f of a compound represent?

-

An access route is being constructed across a field (Figure Q8). Apart from a relatively firm strip of ground alongside the field's longer side AB, the ground is generally marshy. The route can...

-

A mortgage of $35 500 is repaid by making payments of $570 at the end of each month for 15 years. What is the nominal annual rate of interest compounded semi- annually?

-

A property worth $35 000 is purchased for 10% down and semi-annual payments of $2100 for 12 years. What is the nominal annual rate of interest if interest is com- pounded quarterly?

-

Victoria saved $416 every six months for eight years. What nominal rate of interest compounded annually is earned if the savings account amounts to $7720 in eight years?

-

When preparing government-wide financial statements, the modified accrual based governments funds are adjusted. Please show the adjustments (in journal entry form with debits and credits) that would...

-

I need help finding the callable price and call value

-

On 31 October 2022, the owner took goods for his son as a birthday gift. The cost price of the goods was R15 000

Study smarter with the SolutionInn App