Suppose Midtown Community Bank has received a loan application at t = 0 from a firm that

Question:

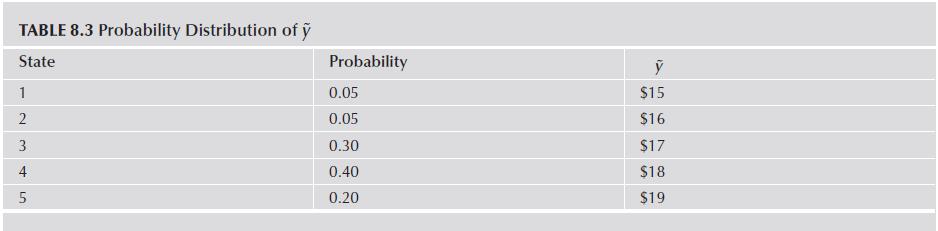

Suppose Midtown Community Bank has received a loan application at t = 0 from a firm that currently has no assets except for an investment opportunity available one period hence, at t = 1. The customer has stipulated that the loan must be made available at t = 0 or not at all. The investment outlay required at t = 1 is Il = $100, of which $55 will come from a bank loan. The firm will make its decision on whether or not to invest at t = 1. The firm currently has some securities outstanding. If the investment is made at t = 1, it will yield $Ỹ per year perpetually, beginning at t = 2. Although Ỹ is not known now, it will be known at t = 1. There are five possible states of the world at t = 1, as shown in Table 8.3 .

Thus, if state 1 is realized at t = 1, the project will pay $15 per year perpetually beginning t = 2. Assume that the riskless rate is 10% and the corporate tax rate is zero. Assuming that $55 of I1 will be financed with a loan, and the rest will come from the firm’s retained earnings, compute Midtown’s expected return as a function of the promised loan interest rate. Assume that I1 is a perpetual loan (a consol) with interest payable at the end of each period, beginning at the end of the first period, that is, at t = 2.

Step by Step Answer:

Contemporary Financial Intermediation

ISBN: 9780124052086

4th Edition

Authors: Stuart I. Greenbaum, Anjan V. Thakor, Arnoud Boot