Question:

Allied Apparel Company received a large order from Websters Department Stores, which operates a chain of approximately 300 popular-priced department stores located primarily in the New England€“Middle Atlantic states. Allied is considering extending trade credit to Websters. As part of its credit check, Allied obtained Websters€™ balance sheets and income statements for the last three years. A check of several of Websters€™ trade creditors has revealed that the firm generally takes any cash discounts when they are offered but averages about 30 days overdue on its payments to two suppliers whose credit terms are €œnet 30.€ A Dun & Bradstreet publication entitled Key Business Ratios yielded the following information concerning the €œaverage€

financial ratios for firms in the same line of business as Websters:

Current assets to current liabilities €¦€¦.....€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦.2.82

Earnings after taxes to sales€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦1.89%

Earnings after taxes to stockholder€™s equity€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦.....€¦.5.65%

Total liabilities to stockholder€™s equity€¦€¦€¦€¦.€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦€¦1.48

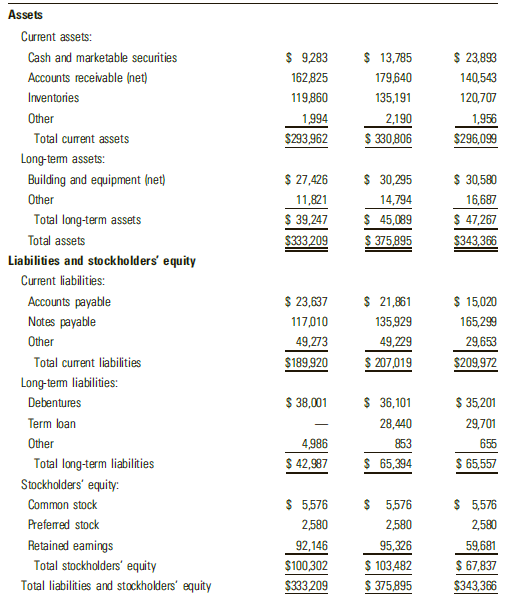

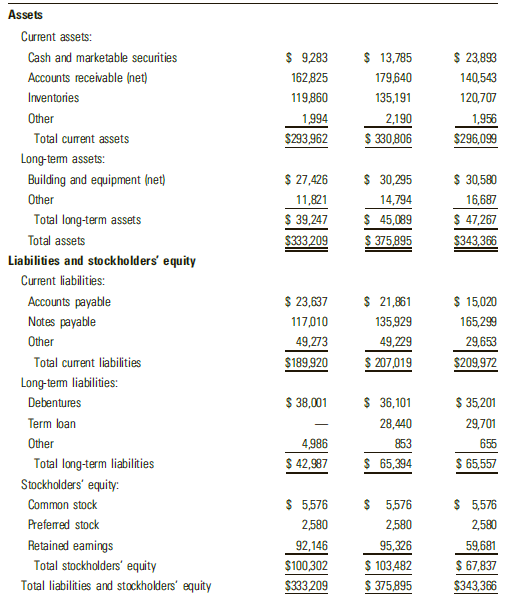

Websters Department Stores Balance Sheet (in Thousands of Dollars)

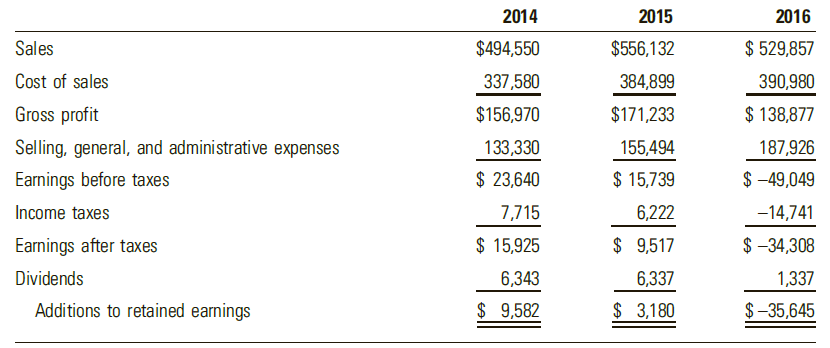

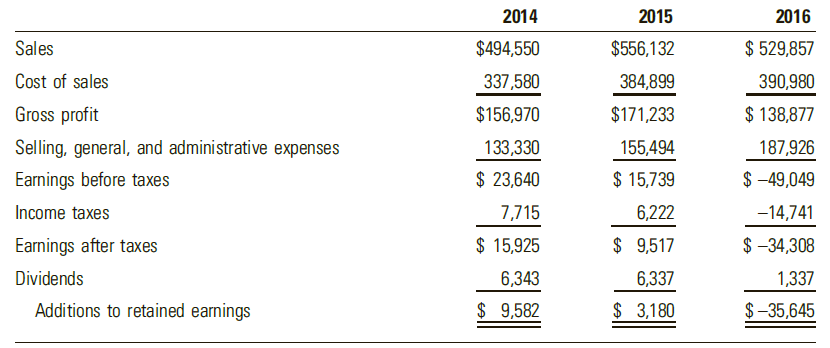

Websters Department Stores Income Statement (in Thousands of Dollars)

In evaluating Websters€™ application for trade credit, answer the following questions:

a. What positive financial factors would lead Allied to decide to extend credit to Websters?

b. What negative financial factors would lead Allied to decide not to extend credit to Websters?

c. What additional information about Websters would be useful in performing the analysis?

Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Financial Ratios

The term is enough to curl one's hair, conjuring up those complex problems we encountered in high school math that left many of us babbling and frustrated. But when it comes to investing, that need not be the case. In fact, there are ratios that,...

Transcribed Image Text:

Assets Current assets: $ 9283 $ 13,785 $ 23,893 Cash and marketable securities Accounts receivable (net) 179,640 140,543 162,825 Inventories 119,860 135,191 120,707 Other 1,994 $293,962 2,190 1,956 $ 330,806 Total current assets $296,099 Long-tem assets: $ 27,426 $ 30,295 $ 30,580 Building and equipment (net) Other 14,794 16,687 11,821 $ 39,247 $333 209 $ 45,089 $ 375,895 $ 47,267 Total long-term assets Total assets $343,366 Liabilities and stockholders' equity Current liabilities: $ 23,637 $ 21,861 $ 15,020 Accounts payable Notes payable 117,010 135,929 165,299 Other 49,229 49,273 $189,920 29,653 $209,972 $ 207,019 Total curent liabilities Long-tem liabilities: $ 35,201 $ 38,001 $ 36,101 Debentures Term loan 29,701 28,440 Other 4,986 853 655 $ 42,987 $ 65,394 $ 65,557 Total long-term liabilities Stockholders' equity: $ 5,576 $ 5,576 $ 5,576 Common stock 2,580 Preferred stock 2,580 2,580 Retained eamings Total stockholders' equity 92,146 95,326 $ 103,482 $ 375,895 59,681 $ 67,837 $100,302 Total liabilities and stockholders' equity $333,209 $343,366 2014 2015 2016 Sales $494,550 $556,132 $ 529,857 Cost of sales 337,580 384,899 390,980 Gross profit $156,970 $171,233 $ 138,877 Selling, general, and administrative expenses 133,330 155,494 187,926 $ -49,049 Earnings before taxes $ 23,640 $ 15,739 Income taxes 7,715 6,222 -14,741 Earnings after taxes $ 15,925 $ 9,517 $ -34,308 Dividends 6,343 6,337 1,337 Additions to retained earnings $ 9,582 $ 3,180 $-35,645