A dental clinic is considering the possibility of replacing its X-ray equipment and buying equipment that allows

Question:

A dental clinic is considering the possibility of replacing its X-ray equipment and buying equipment that allows the on-site, immediate preparation of crowns and bridges. Each pro¬

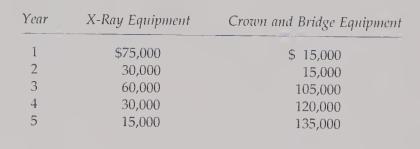

ject would require an investment of $150,000. The X-Ray and crown preparation equipment would each last 5 years and have no expected salvage value. The after-tax cash inflows as¬

sociated with the two independent projects are as follows:

Required:

1. Assuming a discount rate of 12%, compute the net present value of each project.

2. Compute the payback period for each project. Assume that the manager of the com¬

pany accepts only projects with a payback period of 3 years or less. Offer some reasons why this may be a rational strategy even though the NPV computed in Requirement 1 may indicate otherwise.

3. Compute the accounting rate of return for each project using average investment.

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324002324

3rd Edition

Authors: Don R. Hansen, Maryanne M. Mowen