A division of Rico Products has several meat-processing plants. One plant (in Omaha) deals exclusively with chickens.

Question:

A division of Rico Products has several meat-processing plants. One plant (in Omaha) deals exclusively with chickens. The plant produces three products from a common process: pack¬

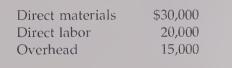

aged breasts, packaged thighs and legs, and the residual. The residual consists of backs and necks, which are sold by the pound to a local soup manufacturer. The packages are sold to supermarkets. The joint costs for a typical week are given below.

The revenues from each product are as follows: breasts, $43,000; legs and thighs, $32,000;

and residual, $25,000.

Management of the Omaha plant is considering processing the chicken breasts beyond the split-off point, which would increase the sales value to $76,000. (The breasts would be cut into nugget-size pieces, breaded, packaged, and sold to supermarkets as chicken nuggets.)

However, the additional processing means that the company must rent some special equip¬

ment costing $1,250 per week. Additional materials and labor also needed would cost $12,750 per week. Resource spending would need to be expanded for other activities as well. The increase in resource spending for these activities is estimated to be $15,000 per week.

Required:

1. What is the gross profit earned by the three products for one week?

2. Should the division process chicken breasts into nuggets or continue to sell the chicken breasts at split-off? What is the effect of the decision on weekly gross profit?

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324002324

3rd Edition

Authors: Don R. Hansen, Maryanne M. Mowen