Abrea, Inc., manufactures trenchers. Abrea uses JIT manufacturing and carries insignificant levels of inventory. Abrea manufactures everything

Question:

Abrea, Inc., manufactures trenchers. Abrea uses JIT manufacturing and carries insignificant levels of inventory. Abrea manufactures everything needed for the trenchers except for the engines. The engines for the smaller trencher line are purchased from two sources: JD En¬

gines and BW Engines. The JD engine is the more expensive of the two sources and has a price of $500. The BW engine is $450 per unit. Abrea produces and sells 22,000 units of the small trencher. Of the 22,000 engines purchased, 4,000 are purchased from JD Engines and 18,000 are purchased from BW Engines. Although Jack Jamison, production manager, prefers the JD engine, Carma Lopez, purchasing manager, maintains that the price difference is too great to buy more than the 4,000 units currently purchased. Carma, however, does want to maintain a significant connection with JD just in case the less expensive source cannot sup¬

ply the needed quantities. Even though Jack understands the price argument, he has argued in many meetings that the quality of the JD engine is worth the price difference. Carma re¬

mains unconvinced.

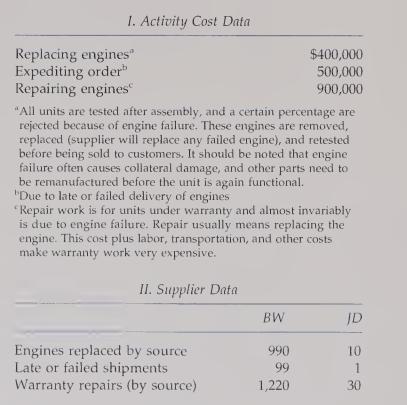

Nancy Dukakis, controller, has recently overseen the implementation of an activitybased costing system. She has indicated that an ABC analysis would shed some light on the conflict between production and purchasing. To support this position, the following data have been collected:

Upon hearing of the proposed ABC analysis, Carma and Jack were both supportive.

Carma, however, noted that even if the analysis revealed that the JD engine was actually less expensive, it would be unwise to completely abandon BW. She argued that JD may be hard pressed to meet the entire demand. Its productive capacity was not sufficient to han¬

dle the kind of increased demand that would be imposed. Additionally, having only one supplier was simply too risky.

Required:

1. Calculate the total supplier cost (acquisition cost plus supplier-related activity costs).

Convert this to a per engine cost to find out how much the company is paying for the engines. Which of the two suppliers is the low cost supplier? Explain why this is a bet¬

ter measure of engine cost than the usual purchase costs assigned to the engines.

2. Consider the supplier cost information obtained in Requirement 1. Suppose further that JD can only supply a total of 10,000 units. What actions would you advise Abrea to un¬

dertake with its suppliers? Comment on the strategic value of activity-based supplier costing.

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324002324

3rd Edition

Authors: Don R. Hansen, Maryanne M. Mowen