After determining the costs of the engineering activities. Bob was then asked to describe how these costs

Question:

After determining the costs of the engineering activities. Bob was then asked to describe how these costs would be assigned to jobs produced within the factory. (The company man¬

ufactures machine parts on a job-order basis.) Bob responded by indicating that creating BOMs and designing tools were the only primary activities. The remaining were secondary activities. After some analysis. Bob concluded that studying manufacturing capabilities was an activity that enabled the other four activities to be realized. He also noted that all of the employees being trained are manufacturing workers—employees who that worked directly on the products. The major manufacturing activities are cutting, drilling, lathing, welding, and assembly. The costs of these activities are assigned to the various products using hours of usage (grinding hours, drilling hours, etc.). Furthermore, tools were designed to enable the production of specific jobs. Finally, the process improvement activity focused only on the fiv'e major manufacturing activities.

Required:

1. What is meant by unbundling general ledger costs? Why is it necessary?

2. What is the difference between a general ledger database system and an activity-based database system?

3. Using the resource drivers and direct tracing, calculate the costs of each manufacturing engineering activity. What are the resource drivers?

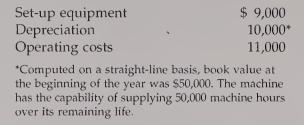

4. Describe in detail how the costs of the engineering activities would be assigned to jobs using activity-based costing. Include a description of the activity drivers that might be used. Where appropriate, identify both a possible transaction driver and a possible duration driver.1/ Larsen Company produces two types of western belts (made of leather): standard and hand¬ crafted. Both belts use equipment for cutting and punching. The equipment also has the capability of creating standard designs. The standard belts use only these standard designs. They are also all of the same width to accommodate the design features of the equipment. The handcrafted belts can be cut to cmy width because the designs are created manually. Many of the manually produced designs are in response to specific requests of retailers. The equipment must be specially configured to accommodate the production of a batch of belts that will receive a handcrafted design. Larsen Company assigns overhead using direct labor dollars. Barry Norton, sales manager, is convitrced that the belts are not being costed correctly. To illustrate his point, he decided to focus oia the expected armual setup and machinerelated costs, which are as follows:

Required:

1. Do you think that the direct labor costs and direct materials costs are accurately traced to each type of belt? Explain.

2. The controller has suggested that overhead costs be assigned to each product using a plantwide rate based on direct labor costs. Machine costs and setup costs are overhead costs. Assume that these are the only overhead costs. For each type of belt, calculate the overhead per unit that would be assigned using a direct labor cost overhead rate. Do you think that these costs are traced accurately to each belt? Explain.

3. Now calculate the overhead cost per unit for belt using two overhead rates: one for the setup activity and one for the machining activity. In choosing a driver to assign the setup costs, did you use number of setups or setup hours? Why? As part of your expla¬

nation, define transaction and duration drivers. Do you think machine costs are traced accurately to each type of belt? Explain.

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324002324

3rd Edition

Authors: Don R. Hansen, Maryanne M. Mowen