Berry Company, a manufacturer of athletic shoes, has adopted JIT manufacturing. In im plementing the system, three

Question:

Berry Company, a manufacturer of athletic shoes, has adopted JIT manufacturing. In im¬

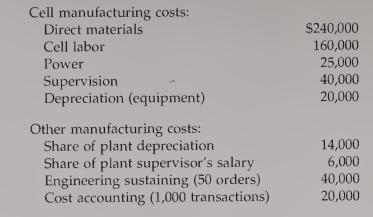

plementing the system, three types of manufacturing cells were created—one for each type of shoe produced. The manufacturing costs for the line of basketball shoes are given below

(expected production of 25,000 units). Cell labor is responsible for operating and maintain¬

ing all cell equipment, moving materials from station to station, inspecting and packing, and cell cleanup.

Engineering-sustaining costs are driven by engineering orders, and cost accounting is dri¬

ven by the number of transactions. These activity costs are fixed but follow a step-cost func¬

tion. Engineering sustaining is acquired in units of 50. Engineering sustaining has 40 units of unused activity capacity. Cost accounting is acquired in units of 2,000. This activity has 200 units of unused activity.

Required:

1. Assume initially that all costs are strictly variable or strictly fixed with respect to units produced. Prepare a cost formula for the following costs:

a. Direct materials

b. Direct labor

c. All directly traceable manufacturing costs other than labor and materials

d. All directly traceable manufacturing costs

e. Total manufacturing costs 2. Assuming that 25,000 pairs of basketball shoes are produced, compute the following, using the cost relationships developed in Requirement 1:

a. Direct material costs

b. Direct labor costs

c. Directly traceable manufacturing costs

d. Total manufacturing costs

e. Unit cost 3. Using the unit-based cost formula, calculate the total manufacturing costs for 30,000 units. Also compute the unit cost. Which costs changed? Why?

4. Now classify costs as unit-level, batch-level, product-level, and facility-level. Calculate total costs for each category for 25,000 and 30,000 units. Which costs changed? Why?

5. Refer to Requirement 4. Suppose that the number of engineering orders increased from 50 to 60 and the number of transactions from 1,000 to 1,100. What happens to total costs for 25,000 units? 30,000 units? Explain.

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324002324

3rd Edition

Authors: Don R. Hansen, Maryanne M. Mowen