Bob Randall, cost accounting manager for Hemple Products, was given the charge to de termine the costs

Question:

Bob Randall, cost accounting manager for Hemple Products, was given the charge to de¬

termine the costs of the activities performed within the company's Manufacturing Engi¬

neering Department. The department has the following activities: creating bills of materials

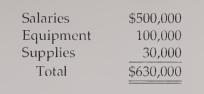

(BOMs), studying manufacturing capabilities, improving manufacturing processes, training employees, and designing tools. The general ledger accounts reveal the following expendi¬

tures for Manufacturing Engineering:

The equipment is used for two activities: improving processes and designing tools. The equipment's time is divided by two activities: 40% for improving processes and 60% for de¬

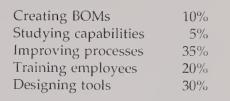

signing tools. The salaries are for nine engineers, one who earns $100,000 and eight who earn $50,000 each. The $100,000 engineer spends 40% of her time training employees in new processes and 60% of her time on improving processes. One engineer spends 100% of her time on designing tools, and another engineer spends 100% of his time on improving processes. The remaining six engineers spend equal time on all activities. Supplies are con¬

sumed in the following proportions:

After determining the costs of the engineering activities. Bob was then asked to describe how these costs would be assigned to jobs produced within the factory. (The company man¬

ufactures machine parts on a job-order basis.) Bob responded by indicating that creating BOMs and designing tools were the only primary activities. The remaining were secondary activities. After some analysis. Bob concluded that studying manufacturing capabilities was an activity that enabled the other four activities to be realized. He also noted that all of the employees being trained are manufacturing workers—employees who that worked directly on the products. The major manufacturing activities are cutting, drilling, lathing, welding, and assembly. The costs of these activities are assigned to the various products using hours of usage (grinding hours, drilling hours, etc.). Furthermore, tools were designed to enable the production of specific jobs. Finally, the process improvement activity focused only on the fiv'e major manufacturing activities.

Required:

1. What is meant by unbundling general ledger costs? Why is it necessary?

2. What is the difference between a general ledger database system and an activity-based database system?

3. Using the resource drivers and direct tracing, calculate the costs of each manufacturing engineering activity. What are the resource drivers?

4. Describe in detail how the costs of the engineering activities would be assigned to jobs using activity-based costing. Include a description of the activity drivers that might be used. Where appropriate, identify both a possible transaction driver and a possible duration driver.

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324002324

3rd Edition

Authors: Don R. Hansen, Maryanne M. Mowen