Charles Bradshaw, president and owner of Wellington Metal Works, has just returned from a trip to Europe.^

Question:

Charles Bradshaw, president and owner of Wellington Metal Works, has just returned from a trip to Europe.^ While there, he toured several plants using robotic manufacturing. See¬

ing the efficiency and success of these companies, Charles became convinced that robotic manufacturing is the wave of the future and that Wellington could gain a competitive ad¬

vantage by adopting the new technology.

Based on this vision, Charles requested an analysis detailing the costs and benefits of robotic manufacturing for the material handling and merchandising equipment group. This group of products consists of such items as cooler shelving, stocking carts, and bakery racks.

The products are sold directly to supermarkets.

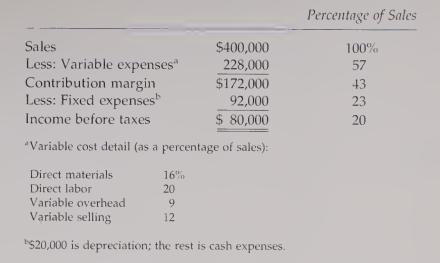

A committee, consisting of the controller, the marketing manager, and the production manager, was given the responsibility to prepare the analysis. As a starting point, the con¬

troller provided the following information on expected revenues and expenses for the ex¬

isting manual system:

Given the current competitive environment, the marketing manager thought that the pre¬

ceding level of profitability would not likely change for the next decade.

After some investigation into various robotic equipment, the committee settled on an Aide 900 system, a robot that has the capability to weld stainless steel or aluminum. It is ca¬

pable of being programmed to adjust the path, angle, and speed of the torch. The produc¬

tion manager was excited about the robotic system because it would eliminate the need to hire welders. This was an attractive possibility because the market for welders seemed per¬

petually tight. By reducing the dependence on welders, better production scheduling and fewer late deliveries would result. Moreover, the robot's production rate is four times that of a person.

It was also discovered that robotic welding is superior in quality to manual welding.

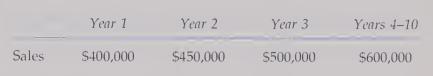

As a consequence, some of the costs of poor quality could be reduced. By providing betterquality products and avoiding late deliveries, the marketing manager was convinced that the company would have such a competitive edge that it would increase sales by 50% for the affected product group by the end of the fourth year. The marketing manager provided the following projections for the next 10 years, the useful life of the robotic equipment:

Currently, the company employs 4 welders, who work 40 hours per week and 50 weeks per year at an average wage of $10 per hour. If the robot is acquired, it will need one operator, who will be paid $10 per hour. Because of improved quality, the robotic system will also reduce the cost of direct materials by 25%, the cost of variable overhead by 33.33 percent, and variable selling expenses by 10%. All of these reductions will take place immediately after the robotic system is in place and operating. Fixed costs will be increased by the de¬

preciation associated with the robot. The robot will be depreciated using MACRS. (The man¬

ual system uses straight-line depreciation without a half-year convention and has a current book value of $200,000.) If the robotic system is acquired, the old system will be sold for $40,000.

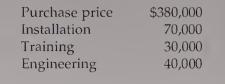

The robotic system requires the following initial investment:

At the end of 10 years, the robot will have a salvage value of $20,000. Assume that the com¬

pany's cost of capital is 12%. The tax rate is 40%.

Required:

1. Prepare a schedule of after-tax cash flows for the manual and robotic systems.

2. Using the schedule of cash flows computed in Requirement 1, compute the NPV for each system. Should the company invest in the robotic system?

3. In practice, many financial officers tend to use a higher discount rate than is justified by the firm's cost of capital. For example, a firm may use a discount rate of 20% when its cost of capital is or could be 12%. Offer some reasons for this practice. Assume that the annual after-tax cash benefit of adopting the robotic system is $80,000 per year more than the manual system. The initial outlay for the robotic system is $340,000.

Compute the NPV using 12% and 20%. Would the robotic system be acquired if 20%

is used? Could this conservative approach have a negative impact on a firm's ability to stay competitive?

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324002324

3rd Edition

Authors: Don R. Hansen, Maryanne M. Mowen