Claude Jones, manager of an Electronic Components Division, was pleased with his divi sion's performance over the

Question:

Claude Jones, manager of an Electronic Components Division, was pleased with his divi¬

sion's performance over the past 3 years. Each year, divisional profits had increased, and he had earned a sizable bonus. (Bonuses are a linear function of the division's reported in¬

come.) He had also received considerable attention from higher management. A vice pres¬

ident had told him in confidence that if his performance over the next 3 years matched his first 3, he would be promoted to higher management.

Determined to fulfill these expectations, Claude made sure that he personally reviewed every capital budget request. He wanted to be certain that any funds invested would pro¬

vide good, solid returns. (The division's cost of capital is 10%.) At the moment, he is re¬

viewing 2 independent requests. Proposal A involves automating a manufacturing opera¬

tion that is currently labor-intensive. Proposal B centers on developing and marketing a new relay component. Proposal A requires an initial outlay of $100,000, and Proposal B requires

$125,000. Both projects could be funded,'given the status of the division's capital budget.

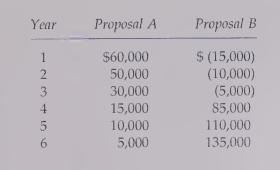

Both have an expected life of 6 years and have the following projected after-tax cash flows:

After careful consideration of each investment, Claude approved funding of Proposal A and rejected Proposal B.

Required:

1. Compute the NPV for each proposal.

2. Compute the payback period for each proposal.

3. According to your analysis, which proposal(s) should be accepted? Explain.

4. Explain why Claude accepted only Proposal A. Considering the possible reasons for rejection, would you judge his behavior to be ethical? Explain.

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324002324

3rd Edition

Authors: Don R. Hansen, Maryanne M. Mowen