Minty-Fresh, Inc., manufactures and sells rolls of soft mint candies. Currently, Minty-Fresh produces only one type of

Question:

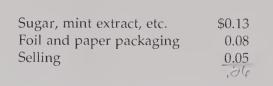

Minty-Fresh, Inc., manufactures and sells rolls of soft mint candies. Currently, Minty-Fresh produces only one type of mint candy. The mints are packaged in 10-ounce rolls and sold to retailers for $0.40 per roll. The variable costs per roll are as follows:

Fixed manufacturing costs total $60,000 per year. Administrative costs (fixed) total $10,000.

Required:

1. Compute the number of rolls of mints that must be sold for Minty-Fresh to break even.

2. How many rolls of mints must be sold for Minty-Fresh to earn a before-tax profit of $28,000?

3. Assuming a tax rate of 30%, how many rolls of mints must be sold to earn an after-tax profit of $31,500?

4. Suppose that Minty-Fresh expects to sell 1.2 million rolls of mints. What is the margin of safety in units and in dollars?

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324002324

3rd Edition

Authors: Don R. Hansen, Maryanne M. Mowen