Rolertyme Company manufactures roller skates. With the exception of the rollers, all parts of the skates are

Question:

Rolertyme Company manufactures roller skates. With the exception of the rollers, all parts of the skates are produced internally. Neeta Booth, president of Rolertyme, has decided to make the rollers instead of buying them from external suppliers. The company needs 100,000 sets per year (currently it pays $1.90 per set of rollers).

The rollers can be produced using an available area within the plant. However, equip¬

ment for production of the rollers would need to be leased ($30,000 per year lease payment).

Additionally, it would cost $0.50 per machine hour for power, oil, and other operating ex¬

penses. The equipment will provide 60,000 machine hours per year. Direct material costs will average $0.75 per set of four, and direct labor will average $0.25 per set. Since only one type of roller would be produced, there would be no additional demands made on the setup activity. Other overhead activities (besides machining and setups), however, would be af¬

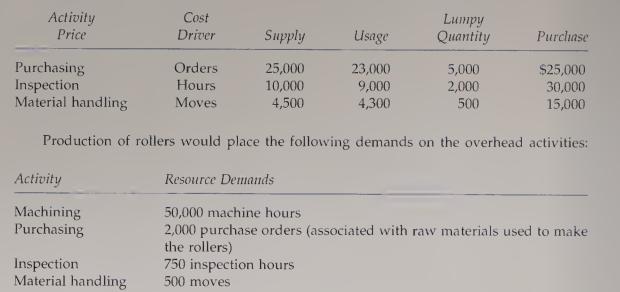

fected. The company's cost management system provides the following information about the current status of the overhead activities that would be affected. (The supply and demand figures do not include the effect of roller production on these activities.) The lumpy quantity indicates how much capacity must be purchased should any expansion of activity sup¬

ply be needed. The purchase price is the cost of acquiring the capacity represented by the lumpy quantity. This price also represents the cost of current spending on existing activity supply (for each block of activity).

Producing the rollers also means that the purchase of outside rollers will cease. Thus, purchase orders associated with the outside acquisition of rollers will drop by 5,000. Simi¬

larly, the moves for the handling of incoming orders will decrease by 200. The company has not inspected the rollers purchased from outside suppliers.

Required:

1. Classify all resources associated with the production of rollers as flexible resources and committed resources. Label each committed resource as short- or long-term commit¬

ments. How should we describe the cost behavior of these short- and long-term resource commitments? Explain.

2. Calculate the total annual resource spending (for all activities except for setups) that the company will incur after production of the rollers begins. Break this cost into fixed and variable activity costs. In calculating these figures, assume that the company will spend no more than necessary. What is the effect on resource spending caused by pro¬

duction of the rollers?

3. Refer to Requirement 2. For each activity, break down the cost of activity supplied into the cost of activity output and the cost of unused activity.

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324002324

3rd Edition

Authors: Don R. Hansen, Maryanne M. Mowen