Solve each of the following independent cases: 1. A printing company has decided to purchase a new

Question:

Solve each of the following independent cases:

1. A printing company has decided to purchase a new printing press. Its old press will be sold for $10,000. (It has a book value of $25,000.) The new press will cost $50,000.

Assuming that the tax rate is 40%, compute the net after-tax cash outflow.

2. The Maintenance Department is purchasing new diagnostic equipment costing $30,000.

Additional cash expenses of $2,000 per year are required to operate the equipment.

MACRS depreciation will be used (five-year property qualification). Assuming a tax rate of 40%, prepare a schedule of after-tax cash flows for the first 4 years.

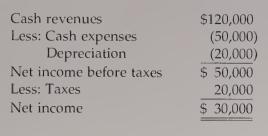

3. The projected income for a project during its first year of operation is given below:

Required:

Compute the following:

a. After-tax cash flow

b. After-tax cash flow from revenues

c. After-tax cash expenses

d. Cash inflow from the shielding effect of depreciation

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324002324

3rd Edition

Authors: Don R. Hansen, Maryanne M. Mowen