The manager of a division that produces electronic audio products is considering the op portunity to invest

Question:

The manager of a division that produces electronic audio products is considering the op¬

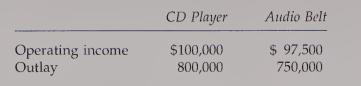

portunity to invest in two independent projects. The first is a waterproof CD player for use in the shower or at poolside. The second, called the "audio belt," is a tape player encased in a belt for joggers. Without the investments, the division will have average assets for the coming year of $18 million and expected operating income of $2.7 million. The expected op¬

erating mcomes and the outlay required for each investment are as follows:

Corporate headquarters has made available up to $2 million of capital for this division.

Any funds not invested by the division will be retained by headquarters and invested to earn the company's minimum required rate, 10%.

Required:

1. Compute the ROI for each investment.

2. Compute the divisional ROI for each of the following four alternatives:

a. The CD player is added.

b. The audio belt is added.

c. Both investments are added.

d. Neither investment is made; the status quo is maintained.

Assuming that divisional managers are evaluated and rewarded on the basis of ROI performance, which alternative do you think the divisional manager will choose?

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324002324

3rd Edition

Authors: Don R. Hansen, Maryanne M. Mowen