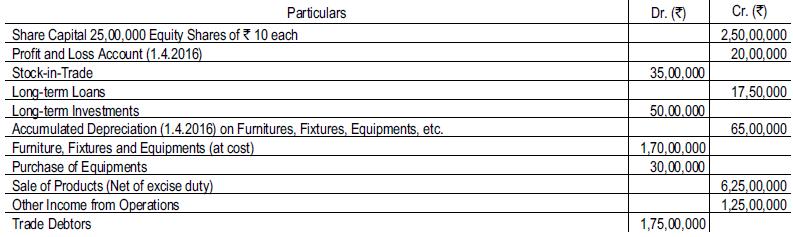

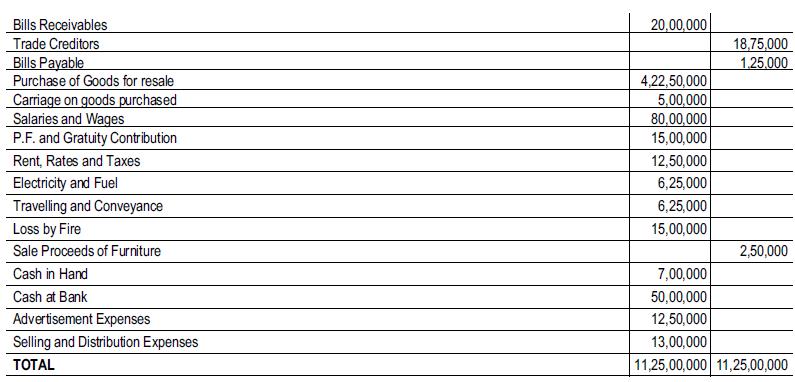

Following is the Trial Balance of X Ltd as on 31st March, 2017: Additional information : (1)

Question:

Following is the Trial Balance of X Ltd as on 31st March, 2017:

Additional information:

Additional information:

(1) Net Realisable Value of closing stock is ₹ 55,00,000. However, it is estimated that the cost of closing stock is ₹ 50,00,000.

(2) It is the policy of the company to charge full year's depreciation for purchase of any asset. However, no depreciation is charged on disposed assets. The rate of deprecition is 20% p.a. on cost on all assets.

(3) During the year 2016-17, The company purchased equipments for ₹ 30,00,000.

(4) Some furniture were sold during the year for ₹ 2,50,000. The original cost was ₹ 15,00,000. Accumulated depreciation is ₹ 7,50,000.

(5) No claim was paid by the Insurance company for loss on fire as the policy was defective.

(6) Proposed dividend is 20% on equity shares.

(7) Corporate dividend tax is 20%.

(8) Rate of Income-tax is 35%.

You are required to prepare:

(i) A Statement of Profit and Loss for the year ended on 31st March, 2017;

(ii) A Balance Sheet as on that date.

Step by Step Answer:

Corporate Accounting As Per The Companies Act 2013 Including Rules 2014 And 2015

ISBN: 9789352605569

2nd Edition

Authors: M Hanif, A Mukherjee