Optimists Ltd. resolved to wind up as on 31.12.2016 as members voluntary winding up. The Trial balance

Question:

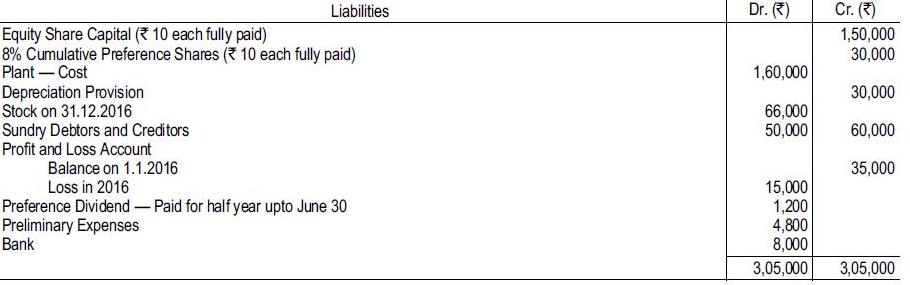

Optimists Ltd. resolved to wind up as on 31.12.2016 as members’ voluntary winding up. The Trial balance as on that date was:

On 1.1.2017 the liquidator sold some of the assets to Optimists (2017) Ltd for the following valuations:

Plant ₹ 90,000; Goodwill ₹ 25,000; Stock ₹ 40,000. The purchase consideration was satisfied by 8% Debentures of ₹ 75,000 issued at 4% discount and the balance in cash. Preference shareholders are to be paid dividend upto the date of commencement of liquidation and 5% premium before anything is paid to equity shareholders. Debtors realised ₹ 40,000 gross, collection expenses being ₹ 500. Six months’ Debenture interest was received from Optimists (2017) Ltd. on 30.6.2017. The creditors were discharged subject to 5% discount. Liquidation expenses amounted to ₹ 800 and liquidator’s remuneration was paid ₹ 4,000. Preference shareholders are paid in cash with premium and dividend. The debentures and cash balance were paid to the equity shareholders. Prepare:

(a) Statement of Affairs as on 31.12.2016 on the basis of facts known as on that date and the agreement with Optimists (2017) Ltd.;

(b) Deficiency Account upto 31.12.2016.

Step by Step Answer:

Corporate Accounting As Per The Companies Act 2013 Including Rules 2014 And 2015

ISBN: 9789352605569

2nd Edition

Authors: M Hanif, A Mukherjee