The financial information of Good Luck Ltd. for the year 2015 are given below: Ratio of Current

Question:

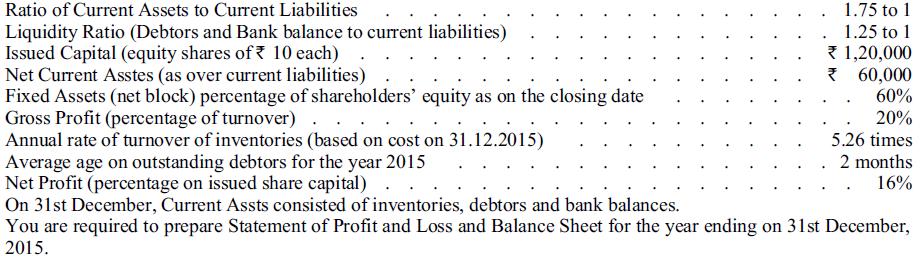

The financial information of Good Luck Ltd. for the year 2015 are given below:

Transcribed Image Text:

Ratio of Current Assets to Current Liabilities Liquidity Ratio (Debtors and Bank balance to current liabilities) Issued Capital (equity shares of 10 each) Net Current Asstes (as over current liabilities) Fixed Assets (net block) percentage of shareholders' equity as on the closing date Gross Profit (percentage of turnover) . . Annual rate of turnover of inventories (based on cost on 31.12.2015) Average age on outstanding debtors for the year 2015 1.75 to 1 1.25 to 1 * 1,20,000 ₹ 60,000 60% 20% 5.26 times 2 months . 16% Net Profit (percentage on issued share capital) .. On 31st December, Current Assts consisted of inventories, debtors and bank balances. You are required to prepare Statement of Profit and Loss and Balance Sheet for the year ending on 31st December, 2015.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 62% (8 reviews)

Lets start by calculating various components step by step 1 Current Assets and Current Liabilities G...View the full answer

Answered By

Faith Chebet

In the past two years many of my students have excell with the knowledge I taught them.

0.00

0 Reviews

10+ Question Solved

Related Book For

Corporate Accounting As Per The Companies Act 2013 Including Rules 2014 And 2015

ISBN: 9789352605569

2nd Edition

Authors: M Hanif, A Mukherjee

Question Posted:

Students also viewed these Business questions

-

Provided below are excerpts from The Walt Disney Company Form 10-K for the fiscal year ended October 3, 2015. Description of the Business and Segment Information The Walt Disney Company, together...

-

Goran is taking out an amortized loan for $18,000 to buy a new car and is deciding between the offers from two lenders. He wants to know which one would be the better deal over the life of the car...

-

Beagle Beauties engages in the development, manufacture, and sale of a line of cosmetics designed to make your dog look glamorous. Below you will find selected information necessary to compute some...

-

An investment was made for $35,000 and and income of $3,000. The ending value of the investment was $34,000. The percentage return on the investment is closest to: 5.7%, 8.6%, 11.8%

-

Listed below are ten independent situations. For each situation indicate (by letter) whether it will create a deferred tax asset (A), a deferred tax liability (L), or neither (N). Situation _____ 1....

-

On January 1, 2008, Gert Enterprises purchased a parcel of land for \($12,000\) cash. At the time of purchase, the company planned to use the land for future expansion. In 2009, Gert Enterprises...

-

Tyler Automotive, Inc., supplies 1,000 independent auto parts stores throughout the United States. Each store is called on 12 times a year, and the average sales call lasts 30 minutes. Assuming a...

-

In Figure a climber leans out against a vertical ice wall that has negligible friction. Distance a is 0.914 m and distance L is 2.10 m. His center of mass is distance d = 0.940 m from the feet-ground...

-

see requirements and refrence photos please Med Max buys surgical supplies from a variety of manufacturers and then resells and delivers these supplies to dozens of hospitals. In the face of...

-

From the following information, prepare the projected Trading and Profit and Loss Account for the next financial year ending December 31, 2015 and the projected Balance Sheet as on that date: Cost of...

-

With the help of information given below, prepare Statement of Profit and Loss and Balance Sheet of Sunshine Ltd. (a) Gross Profit ratio 25%; (b) Net Profit / Sales 20%; (c) Sales Inventory ratio 10;...

-

From the following trial balance (Figure) and adjustment data, complete a worksheet for J. Tripp as of October 31, 201X: a. Depreciation expense, equipment, $1. b. Insurance expired, $5. c. Store...

-

Solve X+1U6x-13x+2-4x+5

-

Summarize the selected poster's design format, such as the color, layout, font style, size, space, and the subject's analysis format. Also, analyze how the study started. Such as background and...

-

Income statement Prior year Current year Revenues 782.6 900.0 Cost of sales Selling costs Depreciation (27.0) (31.3) Operating profit 90.4 85.7 Interest Earnings before taxes 85.4 78.2 Taxes (31.1)...

-

View the video at the slide title "Lab: Social Media Post" at time 28:20. Link:...

-

Write a program ranges.py in three parts. (Test after each added part.) This problem is not a graphics program. It is just a regular text program to illustrate your understanding of ranges and loops....

-

Lou's employer provides a qualified cafeteria plan under which he can choose cash of $9,000 or health and accident insurance premiums worth approximately $7,000. Assuming that Lou is in the 35% tax...

-

If a and b are positive numbers, find the maximum value of f ( x ) = x a (9 x ) b on the interval 0 x 9.

-

During the current year, Kim incurs the following expenses with respect to her beachfront condominium in Hawaii: Item Amount Insurance............................................................ $...

-

Bryce, a bank official, is married and files a joint return. During 2017 he engages in the following activities and transactions: a. Being an avid fisherman, Bryce develops an expertise in tying...

-

Using the following facts, answer the questions below concerning Jarons 2017 tax liability. 1. Two years ago, in November 2015, when his wife died, Jaron left the CPA firm he was working for and...

-

Create a Data Table to depict the future value when you vary the interest rate and the investment amount. Use the following assumptions: Interest Rates: Investment Amounts:-10.0% $10,000.00 -8.0%...

-

Isaac earns a base salary of $1250 per month and a graduated commission of 0.4% on the first $100,000 of sales, and 0.5% on sales over $100,000. Last month, Isaac's gross salary was $2025. What were...

-

Calculate the price, including both GST and PST, that an individual will pay for a car sold for $26,995.00 in Manitoba. (Assume GST = 5% and PST = 8%) a$29,154.60 b$30,234.40 c$30,504.35 d$28,334.75...

Study smarter with the SolutionInn App