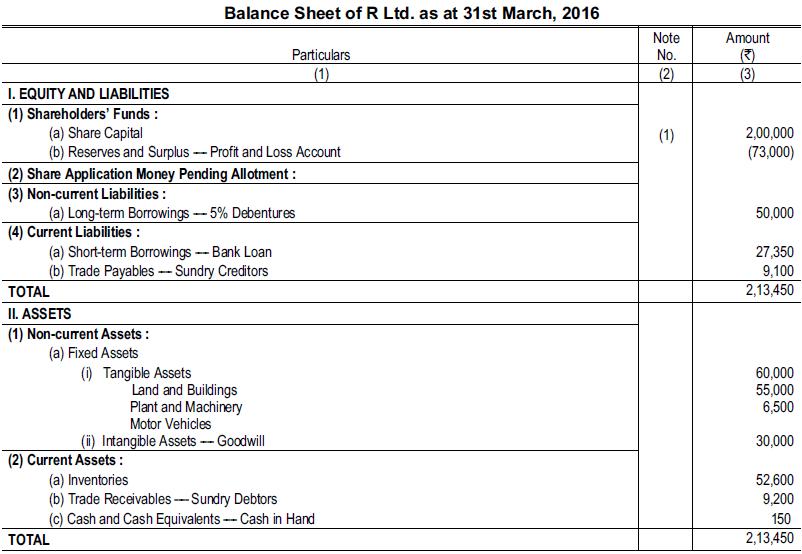

The following was the Balance Sheet of R Ltd. as on March 31, 2016: No preference dividend

Question:

The following was the Balance Sheet of R Ltd. as on March 31, 2016:

No preference dividend has been paid for eight years and the company is handicapped by the antiquated nature of its plant. In the opinion of the directors, if new capital were available and modern plant acquired substantial profits could be earned. Accordingly they proposed a capital reduction scheme as follows :

(i) Each existing Equity Share to be reduced to ₹ 5 each.

(ii) All arrears of Preference Dividend to be cancelled.

(iii) Each existing Preference Share to be reduced to ₹ 75 and then exchanged for one new 6% Cumulative Preference Share of ₹ 50 each and five Equity Shares of ₹ 5 each.

(iv) The credit balance resulting from the above to be applied in eliminating the debit balance on Profit and Loss Account and writing-down Plant and Machinery to ₹ 19,000 and reducing the amount of goodwill.

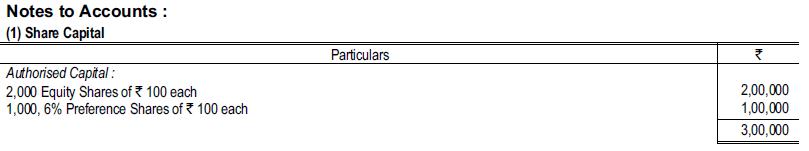

(v) The unissued Preference and Equity Shares to be divided into shares of ₹ 50 and ₹ 5 each respectively and the authorised capital to be restored to ₹ 3,00,000 by the creation of sufficient new Equity Shares.

(vi) All the Debentures to be redeemed at 105 per cent, holders being given the option to subscribe at par for new 4% Debentures. Sanction of the Tribunal to the scheme having been obtained, ₹ 40,000 new Equity Shares were issued at par, payable in full on application. The whole issue was underwritten for a commission of 2.5% and was fully taken up. Holders of old Debentures to the extent of ₹ 20,000 exercised their option and subscribed for the New Debentures. The total expenses incurred by the company in connection with the scheme, excluding underwriting commission, amounted to ₹ 1,350. You are required to show the Journal Entries necessary to record only the reduction scheme and to set out the company’s Balance Sheet after the above arrangements had been carried out.

Step by Step Answer:

Corporate Accounting As Per The Companies Act 2013 Including Rules 2014 And 2015

ISBN: 9789352605569

2nd Edition

Authors: M Hanif, A Mukherjee