Consider the setting of Problems 21 and 22, and suppose Petron Corp. must pay a 25% tax

Question:

Consider the setting of Problems 21 and 22, and suppose Petron Corp. must pay a 25% tax rate on the amount of the final payoff that is paid to equity holders. It pays no tax on payments to, or capital raised from, debt holders.

a. Which strategy will Petron choose with no debt? Which will it choose with a face value of $10 million, $32 million, or $54 million in debt? Assume management maximizes the value of equity, and in the case of ties, will choose the safer strategy.

b. Given your answer to (a), show that the total combined value of Petron’s equity and debt is maximized with a face value of $32 million in debt.

c. Show that if Petron has $32 million in debt outstanding, shareholders can gain by increasing the face value of debt to $54 million, even though this will reduce the total value of the firm.

d. Show that if Petron has $54 million in debt outstanding, shareholders will lose by buying back debt to reduce the face value of debt to $32 million, even though that will increase the total value of the firm.

Problem 21

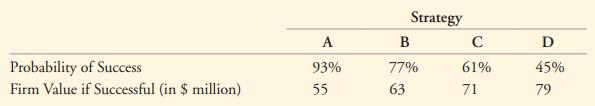

Petron Corporation’s management team is meeting to decide on a new corporate strategy. There are four options, each with a different probability of success and total firm value in the event of success, as shown below:

Problem 22

Consider the setting of Problem 21, and suppose Petron Corp. has debt with a face value of $32 million outstanding. For simplicity assume all risk is idiosyncratic, the risk-free interest rate is zero, and there are no taxes.

Step by Step Answer:

Corporate Finance The Core

ISBN: 9781292158334

4th Global Edition

Authors: Jonathan Berk, Peter DeMarzo