You need to estimate the equity cost of capital for XYZ Corp. You have the following data

Question:

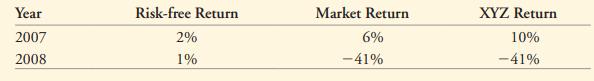

You need to estimate the equity cost of capital for XYZ Corp. You have the following data available regarding past returns:

a. What was XYZ’s average historical return?

b. Compute the market’s and XYZ’s excess returns for each year. Estimate XYZ’s beta.

c. Estimate XYZ’s historical alpha.

d. Suppose the current risk-free rate is 2%, and you expect the market’s return to be 7%. Use the CAPM to estimate an expected return for XYZ Corp.’s stock.

e. Would you base your estimate of XYZ’s equity cost of capital on your answer in part (a) or in part (d)? How does your answer to part (c) affect your estimate? Explain.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance The Core

ISBN: 9781292158334

4th Global Edition

Authors: Jonathan Berk, Peter DeMarzo

Question Posted: