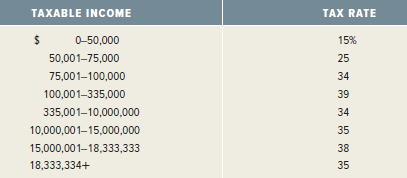

The Alexander Co. had $328,500 in taxable income. Using the rates from Table 2.3 in the chapter,

Question:

Data from Table 2.3

Transcribed Image Text:

TAXABLE INCOME TAX RATE 0-50,000 15% 50,001–75,000 25 75,001–100,000 34 100,001-335,000 39 335,001-10,000,000 34 10,000,001–15,000,000 35 15,000,001–18,333,333 38 18,333,334+ 35

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 72% (11 reviews)

Taxes 1550000 2525000 3425000 39328500 100000 Taxes 111365 T...View the full answer

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Corporate Finance Core Principles and Applications

ISBN: 978-1259289903

5th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Question Posted:

Students also viewed these Business questions

-

Corporation Growth has $79,500 in taxable income, and Corporation Income has $7,950,000 in taxable income. a. What is the tax bill for each firm? b. Suppose both firms have identified a new project...

-

Corporation Growth has $76,500 in taxable income, and Corporation Income has $7,650,000 in taxable income. a. What is the tax bill for each firm? b. Suppose both firms have identified a new project...

-

Corporation Growth has $89,500 in taxable income, and Corporation Income has $8,950,000 in taxable income. a. What is the tax bill for each firm? b. Suppose both firms have identified a new project...

-

SQL database the yellow box is the Order data mentioned in the Q CoursHeroTranscribedText Orders (cust, date, proc, memory, hd, od, quant, price) Exercise 7.4: In Exercise 6.1 we spoke of PC-order...

-

Portsmouth Company makes upholstered furniture. Its only variable cost is direct materials. The demand for the company's products far exceeds its manufacturing capacity. The bottleneck (or...

-

You should recognize that basing a decision solely on expected returns is appropriate only for risk-neutral individuals. Because your client, like virtually everyone, is risk averse, the riskiness of...

-

M/s Anil & Company, a firm of building contractors undertook a contract for construction of a commercial complex on 1st January 1997. The following was the expenditure on the contract for Rs...

-

Barfield Corporation prepares business plans and marketing analyses for startup companies in the Cleveland area. Barfield has been very successful in recent years in providing effective service to a...

-

To carry out a qualifying stock redemption, Turaco Corporation (E & P of $800,000) transfers land held for investment purposes to Aida, a shareholder. The land had a basis of $250,000, a fair market...

-

1. Do you think that only certain individuals are attracted to these types of jobs, or is it the characteristics of the jobs themselves that are satisfying? 2. What characteristics of these jobs that...

-

Klingon Cruisers, Inc., purchased new cloaking machinery three years ago for $7 million. The machinery can be sold to the Romulans today for $5.3 million. Klingons current balance sheet shows net...

-

Timsung, Inc., has sales of $30,700, costs of $11,100, depreciation expense of $2,100, and interest expense of $1,140. If the tax rate is 40 percent, what is the operating cash flow, or OCF?

-

Consider the following statements relating to how we might account for certain transactions or events. What accounting assumption or principle underlies each? 1. Accounting financial statements are...

-

As the human resource manager, how would you evaluate the training needs of your staff? How can you ensure that the training you would provide is effective? What data might be used to make your...

-

MARYLAND CORPORATION manufactures three liquid products - Alpha, Beta and Gamma using a joint process with direct materials, direct labor and overhead totaling $560,000 per batch. In addition, the...

-

Three common organizational structures. Mention one organization for each organizational structure which is following a specific organizational structure. Also, provide support to your answer by...

-

You are a retail manager at Kitchen Nightmare, a relatively new store at the mall that sells mostly items for kitchens, like forks, oven mitts, etc.. You have been open since the fall of 2021 and...

-

Examine the extent to which the Department of Veteran Affairs has established any processes or procedures to ensure knowledge retention of departing employees. Why is it important to manage the...

-

In Problems 750, follow Steps 1 through 7. Steps for Graphing a Rational Function R STEP 1: Factor the numerator and denominator of R. Find the domain of the rational function. STEP 2: Write R in...

-

Briefly describe the following types of group life insurance plans: a. Group term life insurance b. Group accidental death and dismemberment insurance (AD&D) c. Group universal life insurance d....

-

Time Value On subsidized Stafford loans a common source of financial aid for college students, interest does not begin to accrue until repayment begins. Who receives a bigger subsidy, a freshman or a...

-

Calculating EAR Friendlys Quick Loans, Inc., offers you three for four or I knock on your door. This means you get $3 today and repay $4 when you get your paycheck in one week (or else). What the...

-

Present Value of a Growing Perpetuity What is the equation for the present Value of a growing perpetuity with a payment of C one period from today if the payments grow by C each period?

-

Dr. Claudia Gomez, a plastic surgeon, had just returned from a conference in which she learned of a new surgical procedure for removing wrinkles around eyes, reducing the time to perform the normal...

-

QUESTION 2 ( 2 0 Marks ) 2 . 1 REQUIRED Study the information provided below and prepare the Income Statement for the year ended 3 1 December 2 0 2 3 using the marginal costing method. INFORMATION...

-

DROP DOWN OPTIONS: FIRST SECOND THIRD FOURTH 5. Cost of new common stock A firm needs to take flotation costs into account when it is raising capital fromY True or False: The following statement...

Field Guide To Estate Employee And Business Planning 2010 1st Edition - ISBN: 0872189929 - Free Book

Study smarter with the SolutionInn App