Bernard Dumas will receive $10,000 three years from now. Bernard can earn 8 percent on his investments,

Question:

Bernard Dumas will receive $10,000 three years from now. Bernard can earn 8 percent on his investments, so the appropriate discount rate is 8 percent. What is the present value of his future cash flow? The answer is:

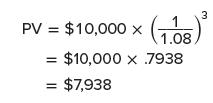

Figure 4.9 illustrates the application of the present value factor to Bernard’s investment. Discounting Bernard Dumas’s Opportunity

When his investments grow at an 8 percent rate of interest, Bernard is equally inclined toward receiving $7,938 now and receiving $10,000 in three years’ time. After all, he could convert the $7,938 he receives today into $10,000 in three years by lending it at an interest rate of 8 percent.

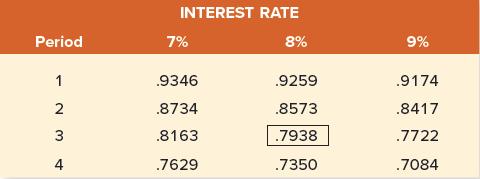

Bernard could have reached his present value calculation in one of several ways. The computation could have been done by hand, by calculator, with a spreadsheet, or with the help of Table A.1, which appears in the back of the text. This table presents the present value of $1 to be received after t periods. We use the table by locating the appropriate interest rate on the horizontal and the appropriate number of periods on the vertical. Bernard would look at the following portion of Table A.1:

The appropriate present value factor is .7938.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe