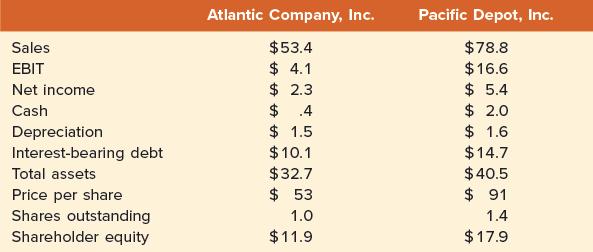

Consider the following 2022 data for Atlantic Company, Inc., and Pacific Depot, Inc. (in billions except for

Question:

Consider the following 2022 data for Atlantic Company, Inc., and Pacific Depot, Inc. (in billions except for price per share):

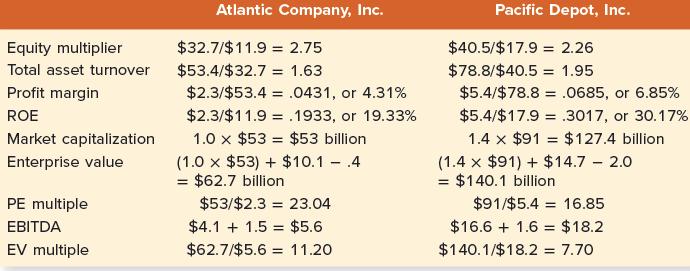

1. Determine the profit margin, ROE, market capitalization, enterprise value, PE multiple, and EV multiple for both Atlantic Company and Pacific Depot.

2. How would you describe these two companies from a financial point of view? Overall, they are similarly situated. In 2022, Pacific Depot had a higher ROE (partially because of a higher total asset turnover and a higher profit margin), but Atlantic had a higher EV multiple.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

Question Posted: