Exoff Oil Corporation is considering the purchase of an oil field in a remote part of Alaska.

Question:

Exoff Oil Corporation is considering the purchase of an oil field in a remote part of Alaska. The seller has listed the property for $10,000 and is eager to sell immediately. Initial drilling costs are $500,000. Exoff anticipates that 10,000 barrels of oil can be extracted each year for many decades. Because the termination date is so far in the future and so hard to estimate, the firm views the cash flow stream from the oil as a perpetuity. With oil prices at $50 per barrel and extraction costs at $46 a barrel, the firm anticipates a net margin of $4 per barrel. Because oil prices are expected to rise at the inflation rate, the firm assumes that its cash flow per barrel will always be $4 in real terms. The appropriate real discount rate is 10 percent. For simplicity, we will ignore taxes. Should Exoff buy the property?

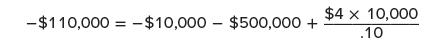

The NPV of the oil field to Exoff is:

According to this analysis, Exoff should not purchase the land.

Though this approach uses the standard capital budgeting techniques of this and other textbooks, it is actually inappropriate for this situation. To see this, consider the analysis of Kirtley Thornton, a consultant to Exoff. He agrees that the price of oil is expected to rise at the rate of inflation. However, he points out that the next year will be quite perilous for oil prices. On the one hand, OPEC is considering a long-term agreement that would raise oil prices to $65 per barrel in real terms for many years in the future. On the other hand, National Motors recently indicated that cars using a mixture of sand and water for fuel are currently being tested. Kirtley argues that oil will be priced at $35 per barrel in real terms for many years should this development prove successful. Full information about both these developments will be released in exactly one year.

Should oil prices rise to $65 a barrel, the NPV of the project would be:

However, should oil prices fall to $35 a barrel, the NPV of the oil field will be even more negative than it is today.

Kirtley makes two recommendations to Exoff’s board. He argues that:

1. The land should be purchased.

2. The drilling decision should be delayed until information about both OPEC’s new agreement and National Motors’ new automobile is released.

Kirtley explains his recommendations to the board by first assuming that the land has already been purchased. He argues that under this assumption, the drilling decision should be delayed. Second, he investigates his assumption that the land should have been purchased in the first place. This approach of examining the second decision (whether to drill) after assuming that the first decision (to buy the land) has been made also was used in our earlier presentation on decision trees. Let us now work through Kirtley’s analysis.

Assume the land has already been purchased. If the land has already been purchased, should drilling begin immediately? If drilling begins immediately, the NPV is −$110,000. If the drilling decision is delayed until new information is released in a year, the optimal choice can be made at that time.

If oil prices drop to $35 a barrel, Exoff should not drill. Instead, the firm should walk away from the project, losing nothing beyond its $10,000 purchase price for the land. If oil prices rise to $65, drilling should begin. Kirtley points out that by delaying, the firm will invest the $500,000 of drilling costs only if oil prices rise. By delaying, the firm saves $500,000 in the case where oil prices drop. Kirtley concludes that once the land is purchased, the drilling decision should be delayed.9 Should the land have been purchased in the first place? We now know that if the land has been purchased, it is optimal to defer the drilling decision until the release of information. Given that we know this optimal decision concerning drilling, should the land be purchased in the first place? Without knowing the exact probability that oil prices will rise, Kirtley is nevertheless confident that the land should be purchased. The NPV of the project at $65 per barrel oil prices is $1,390,000, whereas the cost of the land is only $10,000. Kirtley believes that an oil price rise is possible, though by no means probable. Even so, he argues that the high potential return is clearly worth the risk.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe