Finance.com has an opportunity to invest in a new high-speed computer that costs $50,000. The computer will

Question:

Finance.com has an opportunity to invest in a new high-speed computer that costs $50,000. The computer will generate cash flows of $25,000 one year from now, $20,000 two years from now, and $15,000 three years from now. The computer will be worthless after three years, and no additional cash flows will occur. Finance.com has determined that the appropriate discount rate is 7 percent for this investment. Should Finance.com make this investment in a new high-speed computer? What is the net present value of the investment?

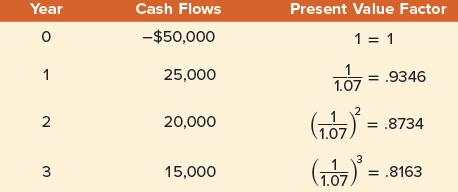

The cash flows and present value factors of the proposed computer are as follows:

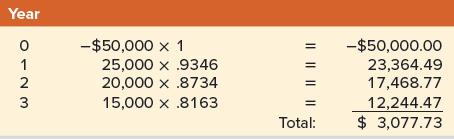

The present value of the cash flows is:

Cash flows × Present value factor = Present value

Finance.com should invest in the new high-speed computer because the present value of its future cash flows is greater than its cost. The NPV is $3,077.73.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe