It is currently 1 January 2010 and Lissom plc is looking to divest itself of one of

Question:

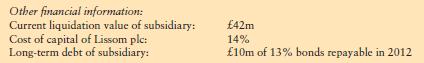

It is currently 1 January 2010 and Lissom plc is looking to divest itself of one of its subsidiaries in order to focus on its core business activities. Financial information relevant to the divestment is given below. Lissom plc has been negotiating the disposal with the subsidiary’s current management team.

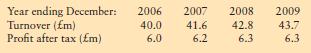

Turnover and profit after tax of the subsidiary over the last five years:

(a) Using the information provided, determine a purchase price for the subsidiary that could be acceptable to both Lissom plc and the management buyout team.

All relevant supporting calculations must be shown.

(b) Discuss any financial aspects of the proposed buyout that you feel should be brought to the attention of the management buyout team.

(c) Discuss the stages that will theoretically be followed by the management buyout of the subsidiary of Lissom plc.

(d) Critically discuss the financing of management buyouts.

Step by Step Answer:

Corporate Finance Principles And Practice

ISBN: 9780273725343

5th Edition

Authors: Denzil Watson, Antony Head