Mansun plc is a listed company with the following capital structure. The 13 per cent bonds give

Question:

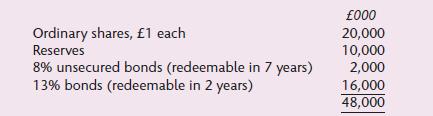

Mansun plc is a listed company with the following capital structure.

The 13 per cent bonds give Mansun plc the right to redeem them at any time before maturity by paying full market value to bondholders. The unsecured bonds have just been issued and their cost is indicative of current financial market conditions. The current share price of Mansun plc is £4.27 and the current market price of the 13 per cent bonds is £105 per £100 bond. Mansun plc has been making regular annual after-tax profits of £10m for some years and pays corporation tax at a rate of 30 per cent.

At a recent board meeting, the finance director suggested that 4m new shares be issued in a rights issue, at a discount of 15 per cent to the company’s current share price, and that the funds raised should be used to redeem part of the 13 per cent bond issue.

Issue costs are expected to be £660,000. The managing director, however, feels strongly that the proceeds of the rights issue should be invested in a project yielding an annual return before tax of 22 per cent.

The board agreed that the price/earnings ratio of the company would be unchanged whichever option was selected and agreed to proceed with the rights issue. One week later, the company announced the rights issue and explained the use to which the funds were to be put.

(a) If capital markets are semi-strong form efficient, determine the expected share price on the announcement of the rights issue under each of the two alternative proposals.

(b) Discuss, with the aid of supporting calculations, whether the rights issue is in the best interests of the shareholders of Mansun plc.

Step by Step Answer:

Corporate Finance Principles And Practice

ISBN: 9781292244310

8th Edition

Authors: Mr Denzil Watson, Antony Head