Pagemaster Enterprises, the company examined in Example 9.4, has 1,000,000 shares of stock outstanding. The stock is

Question:

Pagemaster Enterprises, the company examined in Example 9.4, has 1,000,000 shares of stock outstanding. The stock is selling at $10. What is the required return on the stock?

The payout ratio is the ratio of dividends/earnings. Because Pagemaster’s retention ratio is 40 percent, the payout ratio, which is 1 – Retention ratio, is 60 percent. Recall both that Pagemaster reported earnings of $2,000,000 and that the firm’s growth rate is 6.4 percent.

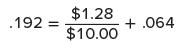

Earnings a year from now will be $2,128,000 (= $2,000,000 × 1.064), implying that dividends will be $1,276,800 (= .60 × $2,128,000). Dividends per share will be $1.28 (= $1,276,800/1,000,000). Given that g = .064, we calculate R from Equation 9.9 as follows:

Example 9.4

Pagemaster Enterprises just reported earnings of $2 million. The firm plans

to retain 40 percent of its earnings in all years going forward. We also could say that 60 percent

of earnings will be paid out as dividends. The ratio of dividends to earnings is often called the

payout ratio, so the payout ratio for Pagemaster is 60 percent. The historical return on equity (ROE) has been 16 percent, which is expected to continue into the future. How much will earnings

grow over the coming year?

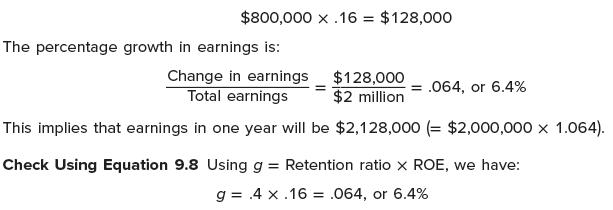

We first perform the calculation without reference to Equation 9.8. Then we use Equation 9.8

as a check. Calculation without Reference to Equation 9.8 The firm will retain $800,000 (= .40 × $2 million ) .

Assuming that historical ROE is an appropriate estimate for future returns, the anticipated

increase in earnings is:

Because Pagemaster’s payout ratio is constant going forward, the growth rate of both earnings

and dividends is 6.4 percent.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe