Popovich Corporation is about to pay a dividend of $3.00 per share. Investors anticipate that the annual

Question:

Popovich Corporation is about to pay a dividend of $3.00 per share. Investors anticipate that the annual dividend will rise by 6 percent a year forever. The applicable discount rate is 11 percent. What is the price of the stock today?

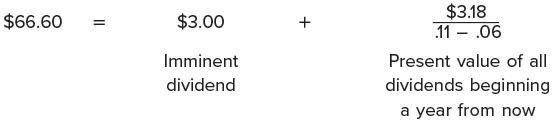

The numerator in Equation 4.12 is the cash flow to be received next period. Because the growth rate is 6 percent, the dividend next year is $3.18 (= $3.00 × 1.06). The price of the stock today is:

The price of $66.60 includes both the dividend to be received immediately and the present value of all dividends beginning a year from now. Equation 4.12 makes it possible to calculate only the present value of all dividends beginning a year from now. Be sure you understand this example; test questions on this subject always seem to trip up a few of our students.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe