Propositions I and II Luteran Motors, an all-equity firm, has expected earnings of $10 million per year

Question:

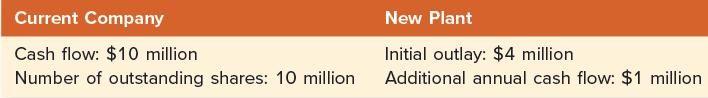

Propositions I and II Luteran Motors, an all-equity firm, has expected earnings of $10 million per year in perpetuity. The firm pays all of its earnings out as dividends, so the $10 million also may be viewed as the stockholders’ expected cash flow. There are 10 million shares outstanding, implying expected annual cash flow of $1 per share. The cost of capital for this unlevered firm is 10 percent. In addition, the firm will soon build a new plant for $4 million.

The plant is expected to generate additional cash flow of $1 million per year. These figures can be described as follows:

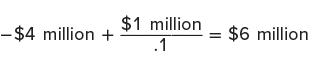

The project’s net present value is:

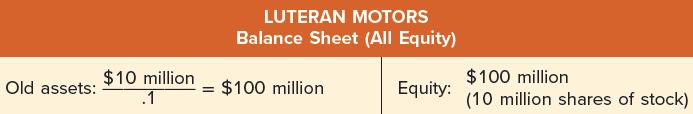

assuming that the project is discounted at the same rate as the firm as a whole. Before the market knows of the project, the market value balance sheet of the firm is:

The value of the firm is $100 million because the cash flow of $10 million per year is capitalized (discounted) at 10 percent. A share of stock sells for $10 ( = $100 million / 10 million ) because there are 10 million shares outstanding.

The market value balance sheet is a useful tool for financial analysis. Because students are often thrown off guard by it initially, we recommend extra study here. The key is that the market value balance sheet has the same form as the balance sheet that accountants use. That is, assets are placed on the left side, whereas liabilities and owners’ equity are placed on the right side. In addition, the left and right sides must be equal. The difference between a market value balance sheet and the accountant’s balance sheet is in the numbers. Accountants value items in terms of historical cost (original purchase price less depreciation), whereas financial analysts value items in terms of market value.

To raise money to cover the cost of building the new plant, the firm will issue $4 million of either equity or debt. Let’s consider the effect of equity and debt financing.

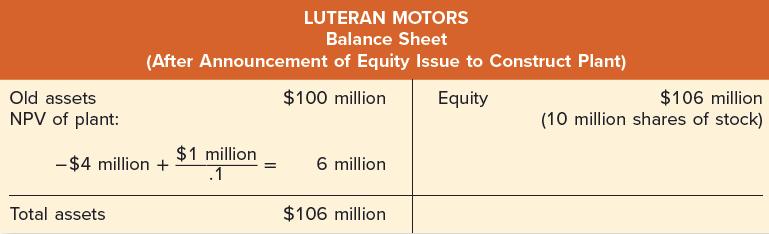

Stock Financing Imagine that the firm announces that in the near future it will raise $4 million in equity to build a new plant. The stock price, and therefore the value of the firm, will rise to reflect the positive net present value of the plant. According to efficient markets, the increase occurs immediately. That is, the rise occurs on the day of the announcement of the new project, not on the date of either the onset of construction of the plant or the forthcoming stock offering.

The market value balance sheet becomes this:

Note that the NPV of the plant is included in the market value balance sheet. Because the new shares have not yet been issued, the number of outstanding shares remains 10 million.

The price per share has now risen to $10.60 (= $106 million/10 million) to reflect news concerning the plant.

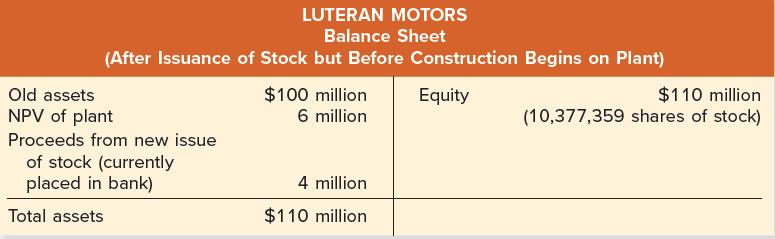

Shortly thereafter, $4 million of stock is issued or floated. Because the stock is selling at $10.60 per share, 377,359 ( = $4 million / $10.60 ) shares of stock are issued. Imagine that the funds are put in the bank temporarily before being used to build the plant. The market value balance sheet becomes this:

The number of shares outstanding is now 10,377,359 because 377,359 new shares were issued. The price per share is $10.60 ( = $110,000,000 / 10,377,359 ) . Note that the price has not changed. This is consistent with efficient capital markets because the stock price should move only due to new information.

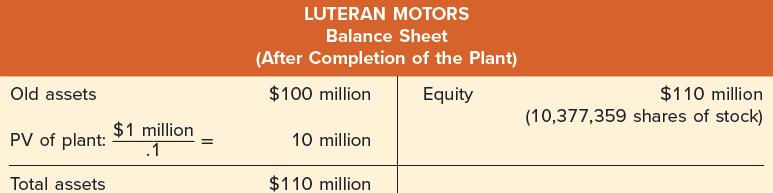

Of course, the funds are placed in the bank only temporarily. Shortly after the new issue, the $4 million is given to a contractor who builds the plant. To avoid problems in discounting, we assume that the plant is built immediately. The balance sheet then looks like this:

Though total assets do not change, the composition of the assets does change. The bank account has been emptied to pay the contractor. The present value of cash flows of $1 million a year from the plant is reflected as an asset worth $10 million. Because the building expenditures of $4 million have already been paid, they no longer represent a future cost. Hence, they no longer reduce the value of the plant. According to efficient capital markets, the price per share of stock remains $10.60.

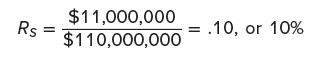

Expected yearly cash flow from the firm is $11 million, $10 million of which comes from the old assets and $1 million from the new. The expected return to equityholders is:

Because the firm is all equity, R S = R 0 = 10 percent.

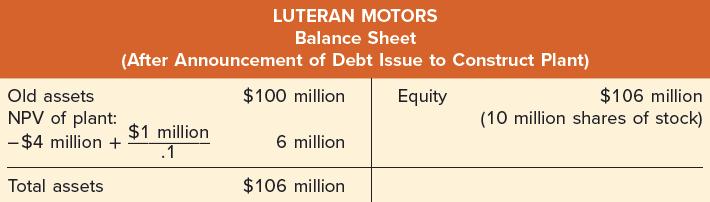

Debt Financing Alternatively, imagine the firm announces that in the near future it will borrow $4 million at 6 percent to build a new plant. This implies yearly interest payments of $240,000 ( = $4,000,000 × .06 ) . Again the stock price rises immediately to reflect the positive net present value of the plant. We have the following:

The value of the firm is the same as in the equity financing case because (1) the same plant is to be built and (2) MM proved that debt financing is neither better nor worse than equity financing.

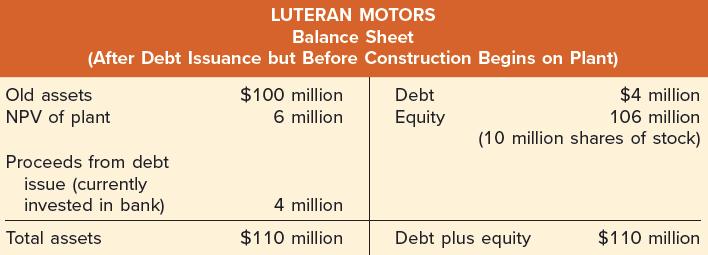

At some point $4 million of debt is issued. As before, the funds are placed in the bank temporarily. The market value balance sheet becomes this:

Note that debt appears on the right side of the balance sheet. The stock price is still $10.60 in accordance with our discussion of efficient capital markets.

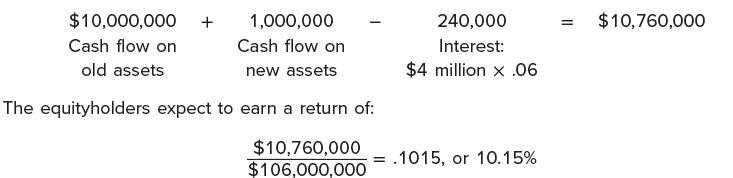

Finally, the contractor receives $4 million and builds the plant. The market value balance sheet turns into this: The only change here is that the bank account has been depleted to pay the contractor. The equityholders expect yearly cash flow after interest of:

This return of 10.15 percent for levered equityholders is higher than the 10 percent return for the unlevered equityholders. This result is sensible because, as we argued earlier, levered equity is riskier. In fact, the return of 10.15 percent should be exactly what MM Proposition II predicts.

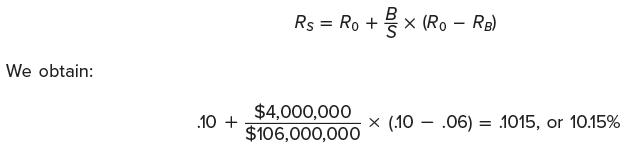

This prediction can be verified by plugging the values into:

This example was useful for two reasons. First, we wanted to introduce the concept of market value balance sheets, a tool that will prove useful elsewhere in the text. Among other things, this technique allows us to calculate the price per share of a new issue of stock. Second, the example illustrates three aspects of Modigliani and Miller:

1. The example is consistent with MM Proposition I because the value of the firm is $110 million after either equity or debt financing.

2. Students are often more interested in stock price than in firm value. We show that the stock price is always $10.60, regardless of whether debt or equity financing is used.

3. The example is consistent with MM Proposition II. The expected return to equityholders rises from 10 to 10.15 percent, just as MM Proposition II states. This rise occurs because the equityholders of a levered firm face more risk than do the equityholders of an unlevered firm.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe