Restwell plc, a hotel and leisure company, is currently considering taking over a smaller private limited company,

Question:

Restwell plc, a hotel and leisure company, is currently considering taking over a smaller private limited company, Staygood Ltd. The board of Restwell is in the process of making a bid for Staygood but first needs to place a value on the company.

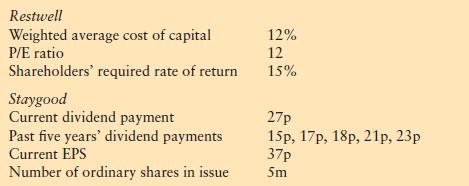

Restwell has gathered the following data:

It is estimated that the shareholders of Staygood require a rate of return 20 per cent higher than that of the shareholders of Restwell owing to the higher level of risk associated with Staygood’s operations. Restwell estimates that cash flows at the end of the first year will be £2.5m and these will grow at an annual rate of 5 per cent. Restwell also expects to raise £5m in two years’ time by selling off hotels of Staygood that are surplus to its needs.

Given the earlier information, estimate values for Staygood using the following valuation methods:

(a) price/earnings ratio valuation;

(b) dividend growth model;

(c) discounted cash flow valuation.

Step by Step Answer:

Corporate Finance Principles And Practice

ISBN: 9780273725343

5th Edition

Authors: Denzil Watson, Antony Head