Scot plc is planning to invest in Glumrovia and, because of risky nature of investments in this

Question:

Scot plc is planning to invest in Glumrovia and, because of risky nature of investments in this part of the world, it will require an after-tax return of at least 20 per cent on the project.

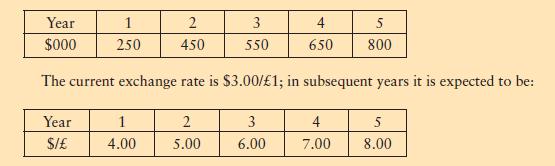

Market research suggests that cash flows from the project in the local currency, the dollar, will be as follows:

The project will cost $600 000 to set up, but the present Glumrovian government will pay $600 000 to Scot plc for the business at the end of the five-year period. It will also lend Scot plc the $250 000 required for initial working capital at the advantageous rate of 6 per cent per year, to be repaid at the end of the five-year period.

Scot plc will pay Glumrovian tax on the after-interest profits at the rate of 20 per cent, while UK tax is payable at the rate of 30 per cent per year. All profits are remitted at the end of each year. There is a double taxation treaty between the two countries. Tax in both countries is paid in the year in which profits arise.

(a) Calculate the net present value of the project and advise on its acceptability.

(b) Discuss the possible problems that might confront a company making the type of decision facing Scot plc.

Step by Step Answer:

Corporate Finance Principles And Practice

ISBN: 9780273725343

5th Edition

Authors: Denzil Watson, Antony Head