Suppose Alpha Air Freight is an all-equity firm with a beta of 1.21. The market risk premium

Question:

Suppose Alpha Air Freight is an all-equity firm with a beta of 1.21. The market risk premium is 9.5 percent and the risk-free rate is 5 percent. We can determine the expected return on the common stock of Alpha Air Freight from Equation 13.1. We find that the expected return is:![]()

Because this is the return that shareholders can expect in the financial markets on a stock with a β of 1.21, it is the return they expect on Alpha Air Freight’s stock.

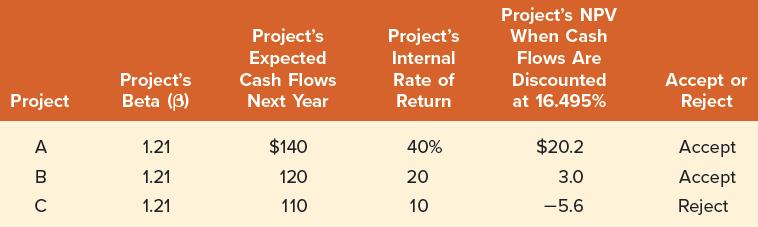

Suppose Alpha is evaluating the following independent projects:

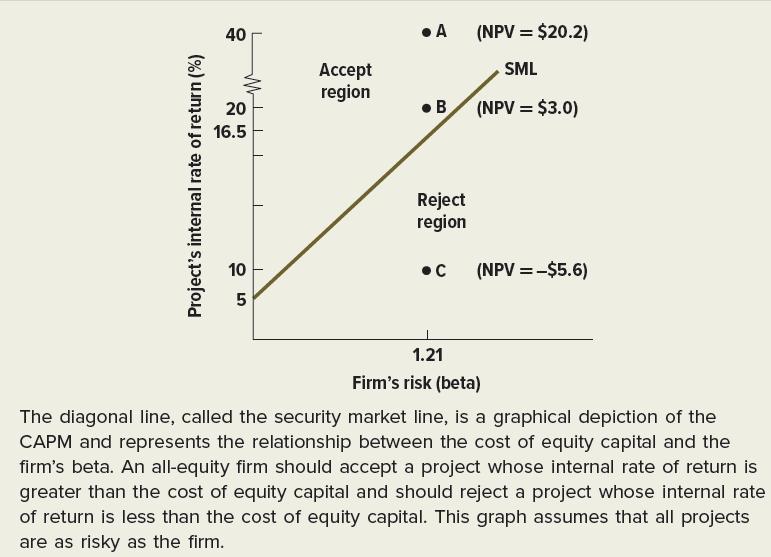

Each project initially costs $100. All projects are assumed to have the same risk as the firm as a whole. Because the cost of equity capital is 16.495 percent, projects in an all-equity firm are discounted at this rate. Projects A and B have positive NPVs and Project C has a negative NPV, so only A and B will be accepted. This result is illustrated in Figure 13.2. Figure 13.2 Using the Security Market Line to Estimate the Risk-Adjusted Discount Rate for Risky Projects

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe