Suppose taxable bonds are currently yielding 8 percent, while at the same time, munis of comparable risk

Question:

Suppose taxable bonds are currently yielding 8 percent, while at the same time, munis of comparable risk and maturity are yielding 6 percent. Which is more attractive to an investor in a 35 percent tax bracket? What is the break-even tax rate?

How do you interpret this rate?

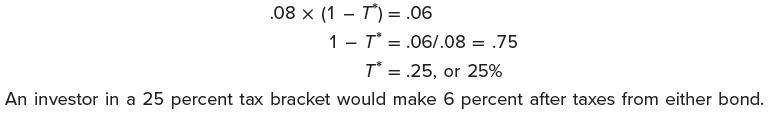

For an investor in a 35 percent tax bracket, a taxable bond yields .08 × ( 1 − .35 ) = .052, or 5.2 percent after taxes, so the muni is more attractive. The break-even tax rate is the tax rate at which an investor would be indifferent between a taxable and a nontaxable issue. If we let T * stand for the break-even tax rate, we can solve for this tax rate as follows:

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe