Suppose the following bond quote for IOU Corporation appears in the financial page of todays newspaper. Assume

Question:

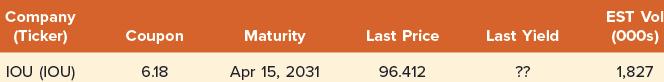

Suppose the following bond quote for IOU Corporation appears in the financial page of today’s newspaper. Assume the bond has a face value of $1,000, it makes semiannual coupon payments, and the current date is April 15, 2022. What is the yield to maturity of the bond? What is the current yield?

Transcribed Image Text:

Company (Ticker) IOU (IOU) Coupon 6.18 Maturity Apr 15, 2031 Last Price 96.412 Last Yield ?? EST Vol (000s) 1,827

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (5 reviews)

To calculate the yield to maturity YTM of the IOU Corporation ...View the full answer

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

Question Posted:

Students also viewed these Business questions

-

Suppose the following bond quote for IOU Corporation appears in the financial page of todays newspaper. Assume the bond has a face value of $1,000 and the current date is April 15, 2010. What is the...

-

Suppose the following bond quote for IOU Corporation appears in the financial page of todays newspaper. Assume the bond has a face value of $1,000 and the current date is April 15, 2016. What is the...

-

Suppose the following bond quote for IOU Corporation appears in the financial page of today's newspaper. Assume the bond has a face value of $1,000, and the current date is April 15, 2008. What is...

-

4. This problem investigates nearest neighbor and bilinear interpolation. For simplicity, we will focus on estimating the image intensity at a single location. Interpolation is used when transforming...

-

A domestic shoe company distributes running shoes and tennis shoes for $95 per pair. The marginal cost of producing a pair of running shoes is $60, and the marginal cost of producing a pair of tennis...

-

Suppose that a gas pipeline averages 1 blemish per 40 km. Find the following probabilities for a section of the pipeline. More than 60 km between successive blemishes if there is at least 40 km...

-

A member of Congress is selected at random. Use the table from Exercise 5 to find the probability of each event. (a) The member is Independent. (b) The member is female and a Republican. (c) The...

-

Media outlets such as ESPN and Fox Sports often have Web sites that provide indepth coverage of news and events. Portions of these Web sites are restricted to members who pay a monthly subscription...

-

Franklin Company's budgeted production calls for 62,000 liters in April and 58,000 liters in May of a key raw material that costs $1.85 per liter. Each month's ending raw materials inventory should...

-

You buy a zero coupon bond at the beginning of the year that has a face value of $1,000, a YTM of 5.3 percent, and 25 years to maturity. If you hold thebond for the entire year, how much in interest...

-

Bond P is a premium bond with a coupon rate of 9 percent. Bond D has a coupon rate of 5 percent and is currently selling at a discount. Both bonds make annual payments, have a par value of $1,000, a...

-

Write a static method eq() that takes two int arrays as arguments and returns true if the arrays have the same length and all corresponding pairs of of elements are equal, and false otherwise.

-

The combined weight of the load and the platform is 200 lb, with the center of gravity located at G. If a couple moment of M = 900 lb ft is applied to link AB, determine the angular velocity of links...

-

Due In: 06:48:23 Questions Question 1 (4) O Question 2 (8) Question 2 of 2 A company sold $150,000 bonds and set up a sinking fund that was earning 8.5% compounded semi-annually to retire the bonds...

-

Find the point on the graph of f(x) = x which is closest to the point (6, 27). How close is the closest point?

-

Due to a crash at a railroad crossing, an overpass is to be constructed on an existing level highway. the existing highway has a design speed of 50 mi/h. The overpass structure is to be level,...

-

Finding Bone Density Scores. In Exercises 37-40 assume that a randomly selected subject is given a bone density test. Bone density test scores are normally distributed with a mean of 0 and a standard...

-

Elaine is a physician who uses the cash method of accounting for tax purposes. During the current year, Elaine bills Ralph 51.200 for office visits and outpatient surgery. Unfortunately, unknown to...

-

-x/2 x/4 If A = -x/2 and A-1 =6 then x equals

-

Explain why a put option on a bond is conceptually the same as a call option on interest rates.

-

A company has a large bond issue maturing in one year. When it matures, the company will float a new issue. Current interest rates are attractive, and the company is concerned that rates next year...

-

A company has a large bond issue maturing in one year. When it matures, the company will float a new issue. Current interest rates are attractive, and the company is concerned that rates next year...

-

You have just been hired as a new management trainee by Earrings Unlimited, a distributor of earrings to various retail outlets located in shopping malls across the country. In the past, the company...

-

Brief Exercise 10-6 Flint Inc. purchased land, building, and equipment from Laguna Corporation for a cash payment of $327,600. The estimated fair values of the assets are land $62,400, building...

-

"faithful respresentation" is the overriding principle that should be followed in ones prepaparation of IFRS-based financial statement. what is it? explain it fully quoting IAS. how this this...

Study smarter with the SolutionInn App