The Midland Company refines and trades gold. At the end of the year, it sold 2,500 ounces

Question:

The Midland Company refines and trades gold. At the end of the year, it sold 2,500 ounces of gold for $1 million. The company had acquired the gold for $900,000 at the beginning of the year. The company paid cash for the gold when it was purchased. Unfortunately, it has yet to collect from the customer to whom the gold was sold.

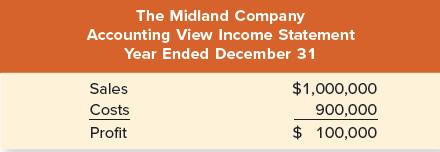

The following is a standard accounting of Midland’s financial circumstances at year-end.

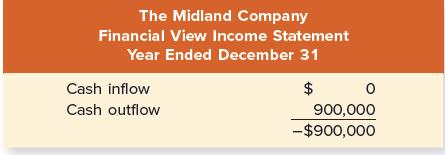

By generally accepted accounting principles (GAAP), the sale is recorded even though the customer has yet to pay. It is assumed that the customer will pay soon. From the accounting perspective, Midland seems to be profitable. The corporate finance perspective focuses on cash flows, as you can see in the following example.

The focus of corporate finance is on whether cash flows are being created by the gold trading operations of Midland. Value creation depends on cash flows. For Midland, value creation depends on whether and when it actually receives $1 million.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe