The Regional Electric Company has $1,000 of extra cash. It can retain the cash and invest it

Question:

The Regional Electric Company has $1,000 of extra cash. It can retain the cash and invest it in Treasury bills yielding 10 percent or it can pay the cash to shareholders as a dividend. Shareholders also can invest in Treasury bills with the same yield. Suppose the corporate tax rate is 21 percent and the personal tax rate is 28 percent for all individuals. Further suppose the maximum tax rate on dividends is 15 percent. How much cash will investors have after five years under each policy?

If dividends are paid now, shareholders will receive:![]()

today after taxes. Because their return after personal tax on Treasury bills is 7.2 percent [ = .10 ×

( 1 − .28 ) ] , shareholders will have:![]()

in five years. Note that interest income is taxed at the personal tax rate (28 percent in this example), but dividends are taxed at the lower rate of 15 percent.

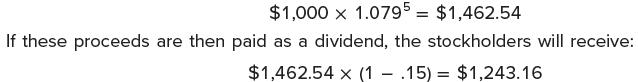

If Regional Electric Company retains the cash to invest in Treasury bills, its aftertax interest rate will be 7.9 percent [ = .10 × ( 1 − .21 ) ] . At the end of five years, the firm will have:

after personal taxes at Year 5. The aftertax value received by stockholders will be greater if the firm pays the dividend in Year 5.

This example shows that for a firm with extra cash, the dividend payout decision will depend on personal and corporate tax rates. If personal tax rates are higher than corporate tax rates, a firm will have an incentive to reduce dividend payouts. However, if personal tax rates are lower than corporate tax rates, a firm will have an incentive to pay out any excess cash as dividends.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe