The Sandar Co. has a debt-equity ratio of .5, a profit margin of 3 percent, a dividend

Question:

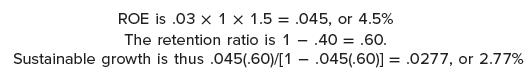

The Sandar Co. has a debt-equity ratio of .5, a profit margin of 3 percent, a dividend payout ratio of 40 percent, and a capital intensity ratio of 1.

What is its sustainable growth rate? If Sandar desired a 10 percent sustainable growth rate and planned to achieve this goal by improving profit margins, what would you think?

For the company to achieve a 10 percent growth rate, the profit margin will have to rise.

To see this, assume that sustainable growth is equal to 10 percent and then solve for profit margin, PM:![.10 PM(1.5)(.6)/[1 PM(1.5)(-6)] PM = .1/.99 = .101, or 10.1%](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1700/3/0/8/0136558a42d402961700308012712.jpg)

For the plan to succeed, the necessary increase in profit margin is substantial, from 3 percent to about 10 percent. This may not be feasible.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe