We are considering the purchase of a $200,000 computer-based inventory management system. It will be depreciated straight-line

Question:

We are considering the purchase of a $200,000 computer-based inventory management system. It will be depreciated straight-line to zero over its four-year life. It will be worth $30,000 at the end of that time. The system will save us $60,000 before taxes in inventory-related costs. The relevant tax rate is 21 percent. Because the new setup is more efficient than our existing one, we can carry less total inventory, thereby freeing up $45,000 in net working capital. What is the NPV at 16 percent? What is the IRR on this investment?

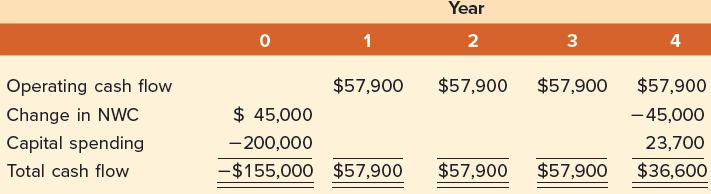

Let’s first calculate the operating cash flow. The after-tax cost savings are $60,000 × (1 − .21) = $47,400 per year. The depreciation is $200,000 / 4 = $50,000 per year, so the depreciation tax shield is $50,000 × .21 = $10,500. Operating cash flow is $47,400 + 10,500 = $57,900 per year.

The system involves a $200,000 upfront cost to buy the system. The after-tax salvage is $30,000 × (1 − .21) = $23,700. Finally, and this is somewhat tricky, the initial investment in net working capital (NWC) is a $45,000 inflow because the system frees up working capital. Furthermore, we will have to put this back in at the end of the project’s life. What this really means is that while the system is in operation, we have $45,000 to use elsewhere.

To finish our analysis, we can compute the total cash flows:

At 16 percent, the NPV is −$4,749, and the IRR is 14.36 percent, so the investment should be rejected.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe