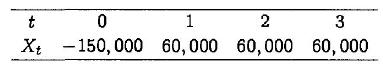

A company is considering a project with the following after-tax cashflows: If the project is all-equity financed

Question:

A company is considering a project with the following after-tax cashflows:

If the project is all-equity financed it has a required rate of return of \(15 \%\). To finance the project the firm issues a 4 year bond with face value of 100,000 and an interest rate of \(5 \%\). Remaining investments are financed by the firm's current operations. The company is facing a tax rate of \(30 \%\).

Determine the NPV of the project.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Lectures On Corporate Finance

ISBN: 9789812568991

2nd Edition

Authors: Peter L Bossaerts, Bernt Arne Odegaard

Question Posted: