Assume a two-factor APT model is appropriate for asset returns, and there are an infinite number of

Question:

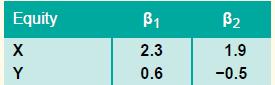

Assume a two-factor APT model is appropriate for asset returns, and there are an infinite number of assets in the economy. Two factors drive expected return: the percentage change in GDP and interest rates. The cross-sectional relationship between expected return and factor betas indicates that GDP is expected to grow by 5 per cent and interest rates will grow by 2 per cent. You have estimated factor betas for equities X and Y as follows:

1. The expected return on an asset having zero betas (with respect to both factors) is 0.03.

According to the APT, what are the approximate equilibrium returns on each of the two equities? (25 marks)

2. Discuss what the theoretical results in the APT say about the number of factors used in this question. (25 marks)

3. The APT expected return relationship looks very similar to the security market line which was derived in the capital asset pricing model. Review the differences between the APT and CAPM. (25 marks)

4. You determine that there are two factors under the APT which affect the portfolios you have constructed for your limited clientele, who invest only in gold equities: the rate of inflation and the growth rate of all gold stocks in relation to the growth rate of all commodity equities.

You determine that the two factors will grow by 0.08 and 0.20, respectively, with zero covariance between the two factors, and the zero beta portfolio’s expected rate of return is 3 per cent. The beta for your gold portfolio is 1.2 with respect to both factors. Calculate the expected rate of return for your portfolio. (25 marks)

Step by Step Answer:

Corporate Finance

ISBN: 9780077173630

3rd Edition

Authors: David Hillier, Stephen A. Ross, Randolph W. Westerfield, Bradford D. Jordan, Jeffrey F. Jaffe