Given the following information for Huntington Power, find the WACC. Assume the companys tax rate is 28

Question:

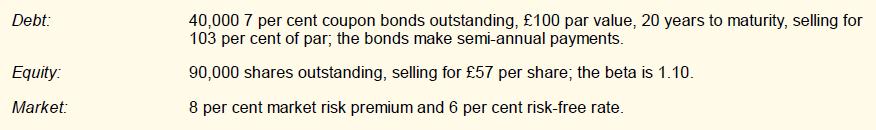

Given the following information for Huntington Power, find the WACC.

Assume the company’s tax rate is 28 per cent.

Transcribed Image Text:

Debt: Equity: Market: 40,000 7 per cent coupon bonds outstanding, 100 par value, 20 years to maturity, selling for 103 per cent of par; the bonds make semi-annual payments. 90,000 shares outstanding, selling for 57 per share; the beta is 1.10. 8 per cent market risk premium and 6 per cent risk-free rate.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (4 reviews)

Answer N...View the full answer

Answered By

Asim farooq

I have done MS finance and expertise in the field of Accounting, finance, cost accounting, security analysis and portfolio management and management, MS office is at my fingertips, I want my client to take advantage of my practical knowledge. I have been mentoring my client on a freelancer website from last two years, Currently I am working in Telecom company as a financial analyst and before that working as an accountant with Pepsi for one year. I also join a nonprofit organization as a finance assistant to my job duties are making payment to client after tax calculation, I have started my professional career from teaching I was teaching to a master's level student for two years in the evening.

My Expert Service

Financial accounting, Financial management, Cost accounting, Human resource management, Business communication and report writing. Financial accounting : • Journal entries • Financial statements including balance sheet, Profit & Loss account, Cash flow statement • Adjustment entries • Ratio analysis • Accounting concepts • Single entry accounting • Double entry accounting • Bills of exchange • Bank reconciliation statements Cost accounting : • Budgeting • Job order costing • Process costing • Cost of goods sold Financial management : • Capital budgeting • Net Present Value (NPV) • Internal Rate of Return (IRR) • Payback period • Discounted cash flows • Financial analysis • Capital assets pricing model • Simple interest, Compound interest & annuities

4.40+

65+ Reviews

86+ Question Solved

Related Book For

Corporate Finance

ISBN: 9780077173630

3rd Edition

Authors: David Hillier, Stephen A. Ross, Randolph W. Westerfield, Bradford D. Jordan, Jeffrey F. Jaffe

Question Posted:

Students also viewed these Business questions

-

Given the following information for Huntington Power Co., find the WACC. Assume the companys tax rate is 35 percent. Debt: 5,000 6 percent coupon bonds outstanding, $1,000 par value, 25 years to...

-

Given the following information for Huntington Power Co., find the WACC. Assume the company's tax rate is 35 percent. Debt: 10,000 5.6 percent coupon bonds outstanding, $1,000 par value, 25 years to...

-

Given the following information for Huntington Power Co., find the WACC. Assume the companys tax rate is 21 percent. Debt: 17,000 4.9 percent coupon bonds outstanding, $2,000 par value, 20 years to...

-

A portfolio manager owns a bond worth 2,000,000 that will mature in one year. The pound is currently worth $1.65, and the one-year future price is $1.61. If the value of the pound were to fall, the...

-

Write the quotient in standard form? 1. 4 / 1 2i 2. 6 5i / i 3. 3 + 2i / 5 + i 4. 7i / (3 + 2i)2

-

How would the balance sheet to this look? Linking Personal Accounting to Business Accounting Chapter 2 AP-5 (0,0) Sheila opened a dormitory locator business called Dormitory Locators near a college...

-

Density curves. (a) Sketch a density curve that is symmetric but has a shape different from that of the Normal curves. (b) Sketch a density curve that is strongly skewed to the right. AppendixLO1

-

Direct material variancessolving for price and usage variances. Fiberworks Company is a manufacturer of fiberglass toy boats. The company has recently implemented a standard cost system and has...

-

Mission Company is preparing its annual profit plan. As part of its analysis of the profitability of individual products, the controller estimates the amount of overhead that should be allocated to...

-

The power systems firm, Raging Volts, has a market value of equity of 15.77 billion and total debt of 1.21 billion. The cost of equity capital is 19.96 per cent and the cost of debt is 5 per cent. If...

-

Kose SA has a target debtequity ratio of 0.80. Its WACC is 10.5 per cent, and the tax rate is 35 per cent. (a) If Koses cost of equity is 15 per cent, what is its pre-tax cost of debt? (b) If instead...

-

Which of the following would not directly change the receivables turnover ratio for a company? a. Increases in the selling prices of your inventory. b. A change in your credit policy. c. Increases in...

-

How do multi-track diplomacy frameworks, integrating official, unofficial, and grassroots efforts at different levels of society, enhance the effectiveness and inclusivity of conflict resolution...

-

As explained by Welch, what should managers do to determine what their own organizations have been up to ?

-

As an administrator how do you demonstrate below situation with suitable examples. 1 Completes tasks to a high standard 2 Demonstrates the necessary level of expertise required to complete tasks and...

-

What influences do the pharmaceutical companies have on psychiatry? What acronym can guide you in formulating a treatment plan (hint: Your instructor emphasizes this when creating a treatment plan,...

-

How do you write a board paper from an article? for example how would y a board paper from the article below look like? Aritcle...

-

Express the quantity 55.69 cal in joules.

-

Identify the tax issues or problems suggested by the following situations. State each issue as a question. Jennifer did not file a tax return for 2007 because she honestly believed that no tax was...

-

Cash management versus liquidity management what is the difference between cash management and liquidity management?

-

Short-tern investments why is referred stock with a dividend tied to short-tern interest rates an attractive short-term investment for corporations with excess cash?

-

Short-tern investments why is referred stock with a dividend tied to short-tern interest rates an attractive short-term investment for corporations with excess cash?

-

Create a Data Table to depict the future value when you vary the interest rate and the investment amount. Use the following assumptions: Interest Rates: Investment Amounts:-10.0% $10,000.00 -8.0%...

-

Isaac earns a base salary of $1250 per month and a graduated commission of 0.4% on the first $100,000 of sales, and 0.5% on sales over $100,000. Last month, Isaac's gross salary was $2025. What were...

-

Calculate the price, including both GST and PST, that an individual will pay for a car sold for $26,995.00 in Manitoba. (Assume GST = 5% and PST = 8%) a$29,154.60 b$30,234.40 c$30,504.35 d$28,334.75...

Study smarter with the SolutionInn App