In Problem 29, are the shareholders of firm T better off with the cash offer or the

Question:

In Problem 29, are the shareholders of firm T better off with the cash offer or the equity offer? At what exchange ratio of B shares to T shares would the shareholders in T be indifferent between the two offers?

Problem 29,

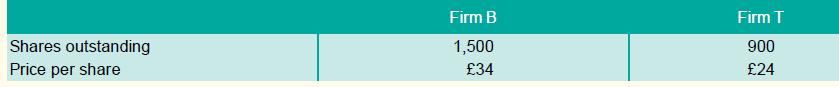

Consider the following pre-merger information about a bidding firm (firm B) and a target firm (firm T). Assume that both firms have no debt outstanding.

Firm B has estimated that the value of the synergistic benefits from acquiring firm T is £3,000.

(a) If firm T is willing to be acquired for £27 per share in cash, what is the NPV of the merger?

(b) What will the price per share of the merged firm be assuming the conditions in (a)?

(c) In part (a), what is the merger premium?

(d) Suppose firm T is agreeable to a merger by an exchange of equity. If B offers three of its shares for every one of T’s shares, what will the price per share of the merged firm be?

(e) What is the NPV of the merger assuming the conditions in (d)?

Step by Step Answer:

Corporate Finance

ISBN: 9780077173630

3rd Edition

Authors: David Hillier, Stephen A. Ross, Randolph W. Westerfield, Bradford D. Jordan, Jeffrey F. Jaffe