The ABC plc cash flow statement for the latest financial year is given below. The appropriate discount

Question:

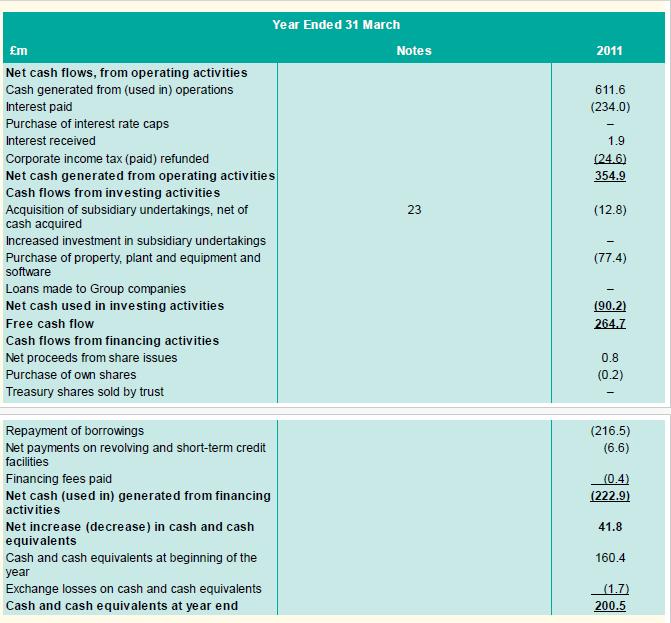

The ABC plc cash flow statement for the latest financial year is given below. The appropriate discount and growth rates are 14 per cent and 4 per cent, respectively. Assume the marginal corporate tax rate is 23 per cent. What is the value of the firm?

Transcribed Image Text:

m Net cash flows, from operating activities Cash generated from (used in) operations Interest paid Purchase of interest rate caps Interest received Corporate income tax (paid) refunded Net cash generated from operating activities Cash flows from investing activities Acquisition of subsidiary undertakings, net of cash acquired Increased investment in subsidiary undertakings Purchase of property, plant and equipment and software Loans made to Group companies Net cash used in investing activities Free cash flow Cash flows from financing activities Net proceeds from share issues Purchase of own shares Treasury shares sold by trust Year Ended 31 March Repayment of borrowings Net payments on revolving and short-term credit facilities Financing fees paid Net cash (used in) generated from financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of the year Exchange losses on cash and cash equivalents Cash and cash equivalents at year end Notes 23 2011 611.6 (234.0) - 1.9 (24.6) 354.9 (12.8) (77.4) (90.2) 264.7 0.8 (0.2) (216.5) (6.6) (0.4) (222.9) 41.8 160.4 (1.7) 200.5

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

So the estima...View the full answer

Answered By

Antony Mutonga

I am a professional educator and writer with exceptional skills in assisting bloggers and other specializations that necessitate a fantastic writer. One of the most significant parts of being the best is that I have provided excellent service to a large number of clients. With my exceptional abilities, I have amassed a large number of references, allowing me to continue working as a respected and admired writer. As a skilled content writer, I am also a reputable IT writer with the necessary talents to turn papers into exceptional results.

4.50+

2+ Reviews

10+ Question Solved

Related Book For

Corporate Finance

ISBN: 9780077173630

3rd Edition

Authors: David Hillier, Stephen A. Ross, Randolph W. Westerfield, Bradford D. Jordan, Jeffrey F. Jaffe

Question Posted:

Students also viewed these Business questions

-

Case Swimmers Headphones1 Finally! Its the end of 2019 and you are sitting at your new desk in a plush office in north Bogota, with a delicious cup of Colombian coffee. You think about all it took to...

-

Youve just been hired onto ABC Company as the corporate controller. ABC Company is a manufacturing firm that specializes in making cedar roofing and siding shingles. The company currently has annual...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Kenny operates a store, where he sells feed and other supplies to farmers. Heather purchases a $20,000 tractor from Kenny and pays Kenny with $18,000 in cash and $2,000 in corn. How much gross income...

-

A company has the opportunity to do any, none, or all of the projects for which the net cash flows per year are shown below. The company has a cost of capital of 12%. Which should the company do and...

-

vestion 5 You can buy the Edward Co.'s perpetual preferred stock that pays dividends of $3.5 per share. At a required rate of return of 4.4% what should be its value

-

From the following particulars, prepare a Bank Reconciliation Statement as on 31 December 1999: (a) Bank overdraft as per passbook 26,000 (b) A cheque for (c) Cheques for were presented 3000 sent for...

-

Peter and Blair recently reviewed their future retirement income and expense projections. They hope to retire in 30 years and anticipate they will need funding for an additional 20 years. They...

-

Marvel Parts, Inc., manufactures auto accessories. One of the company's products is a set of seat covers that can be adjusted to fit nearly any small car. The company has a standard cost system in...

-

The annual earnings of Avalanche Skis will be 6 Swedish kroner per share in perpetuity if the firm makes no new investments. Under such a situation the firm would pay out all of its earnings as...

-

Yorkshire Property Ltd expects to earn 60 million per year in perpetuity if it does not undertake any new projects. The firm has an opportunity to invest 10 million today and 12 million in one year...

-

Give the IUPAC names for each of the following compounds: (a) (CH3CH2)2C==CHCH3 (b) (CH3CH2)2C==C(CH2CH3)2 (c) (CH3)3CCH==CCl2 (d) (e) (f) (g) , ,

-

Small town Diners has a policy of treating dividends as a passive residual. It forecasts that net earnings after taxes in the coming year will be $500,000. The firm has earned the same $500,000 for...

-

Part 1-Chi-Square Goodness-of-Fit Tests A health psychologist was interested in women's workout preferences. Of the 56 participants surveyed, 22 preferred running, 8 preferred swimming, 15 preferred...

-

The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $1,070,000, and it would cost another $21,000 to install it. The machine falls...

-

Problem 1. (10 points) Consider the space X = R22 and the map L XX defined as traceX -traceX L:X X = X 0 0 1. Show that L is a linear map; 2. Find the matrix representation M = mat L in the canonical...

-

Suppose that the exchange rate is 1.25 = 1.00. Options (calls and puts) are available on the Philadelphia exchangein units of10,000 with strike prices of $1.60/1.00. Options (calls and puts) are...

-

A 1.00-L aqueous solution contained 6.78 g of barium hydroxide, Ba(OH)2. What was the pH of the solution at 25C?

-

Synthesize the products by drawing out reagents and intermediates along the way. `N H. OH HO HO

-

Net Present Value Suppose a project has conventional cash flows and a positive we NPV. What do you know about its payback, its discounted payback, its profitability index, its IRR? Explain.

-

Net Present Value Suppose a project has conventional cash flows and a positive we NPV. What do you know about its payback, its discounted payback, its profitability index, its IRR? Explain.

-

Net Present Value Suppose a project has conventional cash flows and a positive we NPV. What do you know about its payback, its discounted payback, its profitability index, its IRR? Explain.

-

An underlying asset price is at 100, its annual volatility is 25% and the risk free interest rate is 5%. A European call option has a strike of 85 and a maturity of 40 days. Its BlackScholes price is...

-

Prescott Football Manufacturing had the following operating results for 2 0 1 9 : sales = $ 3 0 , 8 2 4 ; cost of goods sold = $ 2 1 , 9 7 4 ; depreciation expense = $ 3 , 6 0 3 ; interest expense =...

-

On January 1, 2018, Brooks Corporation exchanged $1,259,000 fair-value consideration for all of the outstanding voting stock of Chandler, Inc. At the acquisition date, Chandler had a book value equal...

Study smarter with the SolutionInn App