Question:

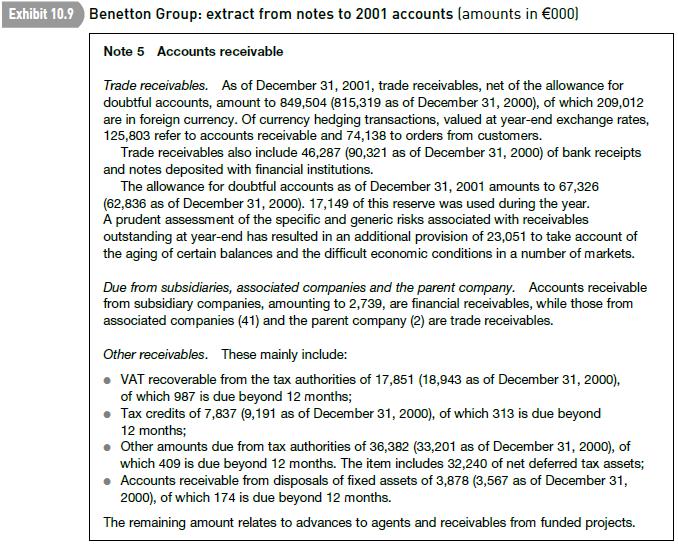

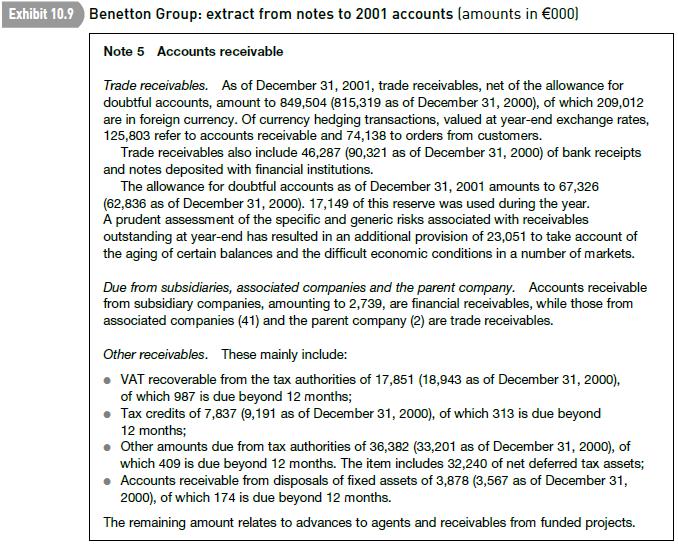

Accounts receivable data in published accounts Benetton is a large Italian clothing manufacturer and retailer. Accounts receivable are a significant asset, amounting to a third of the group’s total reported assets of A2.82 billion at the end of 2001. The end-year receivables figures for 2000 and 2001 are analysed below. They are taken from the group’s 2001 balance sheet and are shown net of the allowance for bad debts.

At 31 December

(In B000) 2001 2000 Accounts receivable Trade receivables 849,504 815,319 Due from subsidiaries, associated companies and the parent company 2,782 5,850 Other receivables 94,677 116,368 Total accounts receivable 946,963 937,537 Benetton provides additional information on its receivables in a note to its accounts (Note 5) reproduced in Exhibit 10.9.

Required

(a) Benetton gives information about the allowance for bad debts (‘doubtful accounts’) in Note 5 to its 2001 accounts. What is the charge the company made for bad debts in its 2001 income statement?

(b) Benetton reports the following sales in 2000 and 2001.

(In B000) 2001 2000 Revenues from sales and services 2,097,613 2,018,112 Benetton’s year-end trade receivables appear high in relation to sales in both 2000 and 2001. Why?

(c) Suggest a reason for the large VAT receivable at year-end.AppenedixLO1

Transcribed Image Text:

Exhibit 10.9 Benetton Group: extract from notes to 2001 accounts (amounts in 000) Note 5 Accounts receivable Trade receivables. As of December 31, 2001, trade receivables, net of the allowance for doubtful accounts, amount to 849,504 (815,319 as of December 31, 2000), of which 209,012 are in foreign currency. Of currency hedging transactions, valued at year-end exchange rates, 125,803 refer to accounts receivable and 74,138 to orders from customers. Trade receivables also include 46,287 (90,321 as of December 31, 2000) of bank receipts and notes deposited with financial institutions. The allowance for doubtful accounts as of December 31, 2001 amounts to 67,326 (62,836 as of December 31, 2000). 17,149 of this reserve was used during the year. A prudent assessment of the specific and generic risks associated with receivables outstanding at year-end has resulted in an additional provision of 23,051 to take account of the aging of certain balances and the difficult economic conditions in a number of markets. Due from subsidiaries, associated companies and the parent company. Accounts receivable from subsidiary companies, amounting to 2,739, are financial receivables, while those from associated companies (41) and the parent company (2) are trade receivables. Other receivables. These mainly include: VAT recoverable from the tax authorities of 17,851 (18,943 as of December 31, 2000), of which 987 is due beyond 12 months; Tax credits of 7,837 (9,191 as of December 31, 2000), of which 313 is due beyond 12 months; Other amounts due from tax authorities of 36,382 (33,201 as of December 31, 2000), of which 409 is due beyond 12 months. The item includes 32,240 of net deferred tax assets; Accounts receivable from disposals of fixed assets of 3,878 (3,567 as of December 31, 2000), of which 174 is due beyond 12 months. The remaining amount relates to advances to agents and receivables from funded projects.