Analysis of pension plan disclosures II Toray Industries is a Japanese manufacturer of fibres, textiles, plastics and

Question:

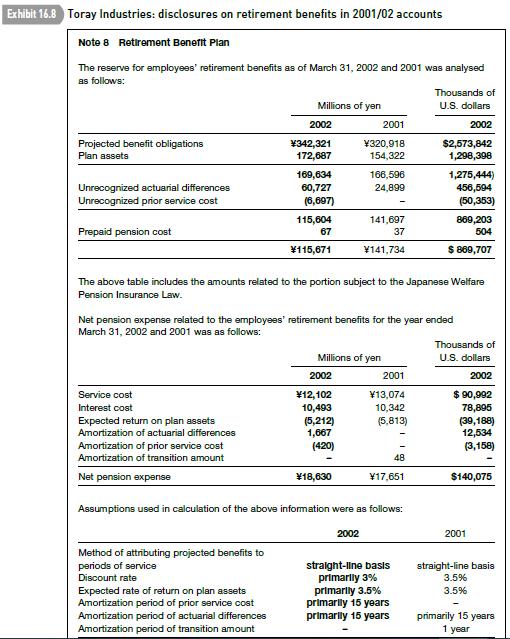

Analysis of pension plan disclosures II Toray Industries is a Japanese manufacturer of fibres, textiles, plastics and chemicals. The group reported worldwide sales of ¥1,016 billion (US$7.6 billion) and net profits of ¥3.8 billion in the year to 31 March 2002. It reported a pension liability of ¥115,671 million (and a pension asset of ¥67 million)

on its end-March 2002 balance sheet.

Exhibit 16.8 contains extracts from the notes to the company’s 2001/02 consolidated accounts.

The company adopted a new national accounting standard on retirement benefits as of 1 April 2000.

The standard brings Japanese accounting practice into line with IAS. According to the company, the net recognised liability represents ‘the estimated present value of projected benefit obligations [i.e.

including the effect of expected salary increases] in excess of the fair value of plan assets except that, as permitted under the new standard, unrecognised actuarial differences and unrecognised prior service cost are amortized on a straight-line basis over a period of 15 years’ (Annual Report 2001/02, p.40).

The company also discloses that it contributed marketable equity securities to the retirement benefit plan in the year to 31 March 2002. The securities had a fair value of ¥22,005 million at the date of transfer.

Required

(a) Are Toray’s retirement benefit plans over- or underfunded at 31 March 2002? What is the amount of the over- or underfunding?

(b) Toray reports ‘Unrecognised actuarial differences’ of ¥60,727 million at end-March 2002. Are these differences gains or losses? Suggest possible reasons why the differences more than doubled between end-March 2001 and end-March 2002.

(c) Compare Toray’s retirement benefit disclosures with those of Roche (see Exhibit 16.5). What are the disclosures Roche makes but Toray doesn’t that investors in Toray would find helpful, in your opinion?AppenedixLO1

Step by Step Answer: